In the bustling financial markets of the United States, the US Financial Stocks Index plays a crucial role in gauging the health and performance of the sector. This article aims to provide a comprehensive understanding of this index, its components, and its significance in the financial world. By delving into its historical background, key components, and performance over time, we'll uncover why investors and analysts alike keep a close eye on the US Financial Stocks Index.

The Historical Background of the US Financial Stocks Index

The US Financial Stocks Index has a rich history that dates back to the early 1980s. Initially, it was developed by the S&P Dow Jones Indices and was known as the S&P Financial Sector Index. Over the years, this index has evolved to reflect the dynamic nature of the financial industry, with various companies and sectors being added and removed.

Key Components of the US Financial Stocks Index

The US Financial Stocks Index is composed of a diverse range of financial companies, including banks, insurance companies, and real estate investment trusts (REITs). Some of the key components of this index include:

- Banks: These companies offer various financial services such as lending, investment, and retail banking. Some prominent examples include JPMorgan Chase, Bank of America, and Wells Fargo.

- Insurance Companies: These companies provide protection against various risks, including life, health, and property insurance. Major players in this segment include MetLife, Prudential Financial, and Allstate.

- REITs: These companies invest in real estate properties and generate income through rental income and capital appreciation. Examples of well-known REITs include Public Storage and American Tower Corporation.

Performance of the US Financial Stocks Index

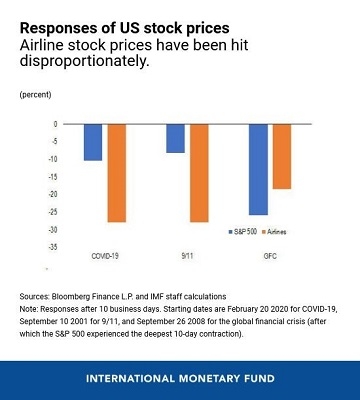

Over the years, the US Financial Stocks Index has demonstrated a strong performance, often outperforming other sectors. This can be attributed to the robust nature of the financial industry, which tends to recover quickly from downturns. However, it is important to note that the index is subject to volatility, particularly during economic crises and market disruptions.

Case Study: The 2008 Financial Crisis

One of the most significant events in the history of the US Financial Stocks Index was the 2008 financial crisis. The crisis led to a sharp decline in the index, as banks and financial institutions faced immense pressure. However, the index recovered swiftly over the subsequent years, reflecting the resilience of the financial sector.

Significance of the US Financial Stocks Index

The US Financial Stocks Index is a valuable tool for investors and analysts for several reasons:

- Market Trend Analysis: By tracking the performance of the index, investors can gain insights into the overall health of the financial sector.

- Investment Decisions: The index can help investors identify attractive investment opportunities in the financial industry.

- Comparative Analysis: The index allows investors to compare the performance of individual companies against the broader market.

Conclusion

In conclusion, the US Financial Stocks Index is a crucial indicator of the financial sector's performance. By understanding its components, performance, and significance, investors and analysts can make informed decisions in the dynamic world of finance. Whether you are a seasoned investor or a beginner, keeping an eye on the US Financial Stocks Index can help you navigate the financial markets with confidence.

vanguard total stock market et