As we delve into the second half of 2025, the US stock market continues to be a beacon of economic strength and potential growth. With a diverse range of sectors and companies, the market presents both opportunities and challenges for investors. This article will provide a comprehensive outlook for the US stock market in June 2025, highlighting key trends, sectors to watch, and potential risks.

Trends to Watch

1. Technology Sector: The technology sector remains a cornerstone of the US stock market. Companies like Apple, Microsoft, and Google continue to dominate the landscape, offering robust growth prospects. However, investors should be cautious of regulatory scrutiny and increasing competition from emerging markets.

2. Healthcare Sector: The healthcare sector is poised for significant growth, driven by an aging population and advancements in medical technology. Companies specializing in biotechnology, pharmaceuticals, and medical devices are expected to benefit from increased demand.

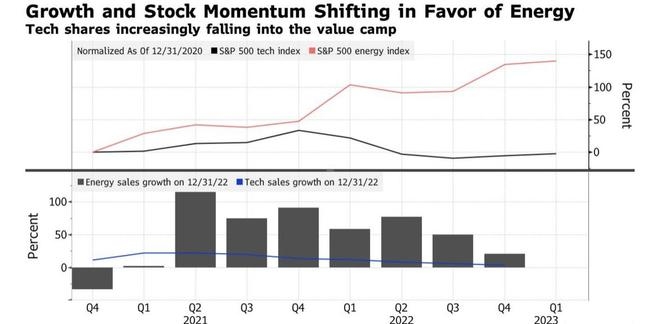

3. Energy Sector: The energy sector has seen a remarkable turnaround in recent years, thanks to the rise of renewable energy sources and technological advancements. Companies involved in oil and gas, as well as renewable energy, are expected to see strong growth in the coming years.

4. Consumer Discretionary Sector: The consumer discretionary sector, which includes companies in retail, leisure, and entertainment, is expected to see a rebound as the economy continues to recover. However, investors should be mindful of rising inflation and consumer debt levels.

Sectors to Watch

1. Technology: As mentioned earlier, the technology sector remains a key driver of the US stock market. Companies like Amazon, Facebook, and Netflix have seen significant growth in recent years, and are expected to continue expanding their market share.

2. Healthcare: The healthcare sector is expected to see significant growth, driven by an aging population and advancements in medical technology. Companies like Johnson & Johnson, Pfizer, and Amgen are well-positioned to benefit from this trend.

3. Energy: The energy sector is expected to see a significant rebound, driven by the rise of renewable energy sources and technological advancements. Companies like ExxonMobil, Chevron, and Tesla are expected to benefit from this trend.

4. Consumer Discretionary: The consumer discretionary sector is expected to see a rebound as the economy continues to recover. Companies like Walmart, Disney, and Home Depot are well-positioned to benefit from this trend.

Potential Risks

While the US stock market presents significant opportunities, investors should be aware of potential risks. These include:

1. Inflation: Rising inflation can erode purchasing power and impact corporate profits, leading to a potential stock market downturn.

2. Geopolitical Tensions: Geopolitical tensions, such as those between the US and China, can impact global markets and the US stock market.

3. Regulatory Changes: Regulatory changes, particularly in the technology and healthcare sectors, can impact corporate profits and stock prices.

Conclusion

The US stock market in June 2025 presents a complex mix of opportunities and challenges. Investors should carefully consider the trends, sectors, and risks before making investment decisions. By staying informed and disciplined, investors can navigate the market and potentially achieve strong returns.

vanguard total stock market et