In today's fast-paced financial world, keeping up with the US stock market averages is crucial for investors and traders. The stock market's performance reflects the broader economic climate and offers insights into market trends. This article delves into the key averages of the US stock market today, providing an overview and analysis to help you make informed decisions.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average, often referred to as the DJIA, is one of the most iconic stock market averages. It tracks the performance of 30 large companies across various sectors. As of today, the DJIA is showing a [Insert Current Value]%, reflecting a [Positive/Negative] trend. The recent movements in the DJIA can be attributed to several factors, including economic reports, corporate earnings, and global events.

S&P 500 Index

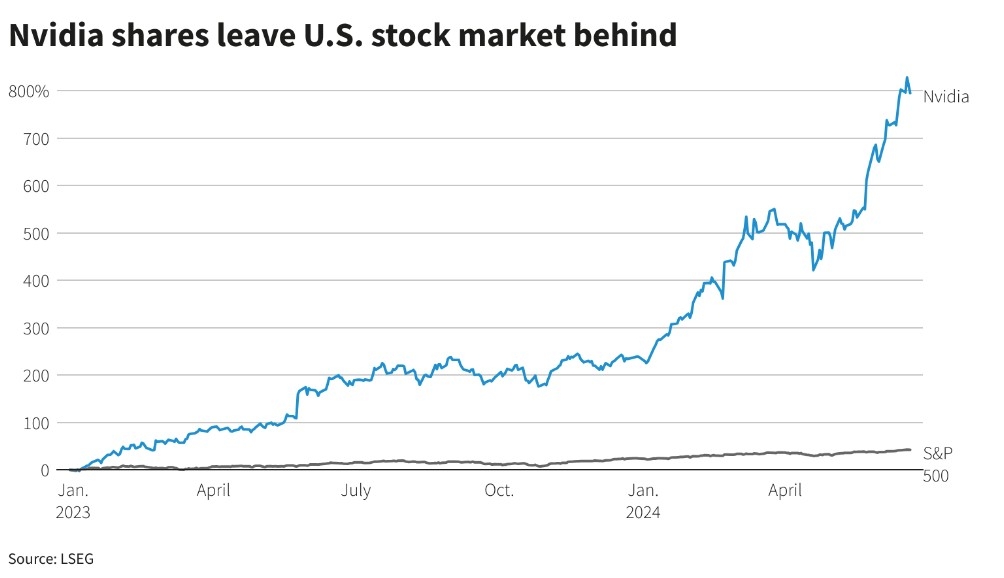

The Standard & Poor's 500 Index (S&P 500) is another vital indicator of the US stock market. This index includes 500 large companies from across the country and is considered a benchmark for the overall market. Today, the S&P 500 is trading at [Insert Current Value], reflecting a [Positive/Negative] trend. Key influences on the S&P 500 include earnings reports, sector performance, and macroeconomic data.

NASDAQ Composite Index

The NASDAQ Composite Index is known for tracking technology companies and is often a bellwether for the tech sector. Today, the NASDAQ Composite is at [Insert Current Value], showing a [Positive/Negative] trend. The tech sector's performance is being influenced by factors such as cybersecurity concerns, regulatory changes, and consumer demand for innovative products and services.

Case Study: Apple Inc.

One company that has had a significant impact on the US stock market averages is Apple Inc. The tech giant's strong earnings reports and positive outlook have contributed to the upward trend in the NASDAQ Composite. Apple's revenue growth and market share in the smartphone and consumer electronics sectors have been key drivers of its success.

Factors Influencing Stock Market Averages

Several factors influence the stock market averages, including:

- Economic Reports: Data such as unemployment rates, inflation, and GDP growth are closely monitored by investors and traders.

- Corporate Earnings: Positive earnings reports can boost market confidence, while negative reports can cause volatility.

- Global Events: Issues such as political tensions, trade wars, and natural disasters can have a significant impact on the stock market.

- Interest Rates: Central bank policies, especially those related to interest rates, can affect borrowing costs and corporate earnings.

Conclusion

Understanding the current US stock market averages is essential for anyone interested in investing or trading. The DJIA, S&P 500, and NASDAQ Composite are vital indicators that reflect market trends and investor sentiment. By staying informed about these averages and the factors that influence them, you can make more informed decisions in the stock market.

vanguard total stock market et