In today's dynamic financial landscape, the U.S. government's investment portfolio is a topic of significant interest. From mutual funds to stocks, the federal government has a diverse range of investments. This article delves into the stocks the U.S. government owns, offering insights into its investment strategies and potential implications.

Understanding the Federal Government's Investment Portfolio

The U.S. government's investment portfolio is managed by various entities, including the Treasury Department and the Federal Reserve. These organizations make strategic decisions to invest in a variety of assets, including stocks, bonds, and other securities.

One of the most notable aspects of the government's investment portfolio is its ownership of stocks. This ownership is a result of various initiatives, including the sale of assets and the reinvestment of profits. The government's investments in stocks are diverse, covering sectors such as technology, finance, and healthcare.

Key Stocks Held by the U.S. Government

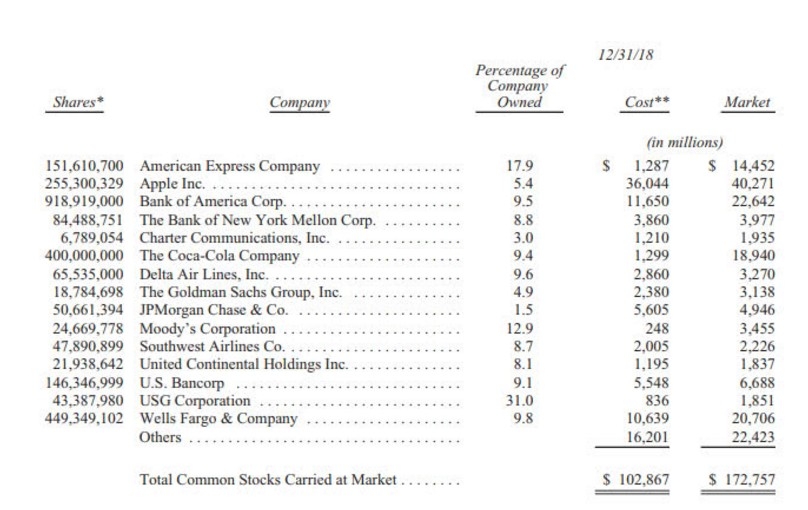

The U.S. government owns shares in numerous publicly-traded companies. Some of the most prominent include:

- Apple Inc. (AAPL): As the world's largest technology company, Apple has been a favorite of the U.S. government. The government's stake in Apple is significant, reflecting its confidence in the company's long-term growth potential.

- Microsoft Corporation (MSFT): Another tech giant, Microsoft, has also caught the government's eye. The government's investment in Microsoft highlights its belief in the company's ability to innovate and adapt to changing market conditions.

- Johnson & Johnson (JNJ): As a leading healthcare company, Johnson & Johnson is a staple in the government's investment portfolio. The government's investment in JNJ underscores its commitment to healthcare and wellness.

Investment Strategies and Implications

The U.S. government's investment strategies are designed to maximize returns while minimizing risk. By diversifying its portfolio across various sectors and asset classes, the government aims to achieve stable and consistent growth.

One of the key implications of the government's stock investments is its potential impact on the market. As a significant shareholder in many companies, the government's actions can influence stock prices and market dynamics. This, in turn, can have broader implications for the economy.

Case Studies

To illustrate the impact of the government's stock investments, let's consider a few case studies:

- Apple Inc. (AAPL): In 2011, the U.S. government announced its intention to invest $100 million in Apple. This investment came at a time when Apple was facing scrutiny over its tax practices. The government's investment was seen as a way to support the company and its innovation.

- Johnson & Johnson (JNJ): In 2019, the U.S. government announced its intention to increase its stake in Johnson & Johnson. This move came amidst a healthcare reform debate in the country. The government's investment was seen as a way to support the company's commitment to healthcare and wellness.

Conclusion

The U.S. government's investment in stocks is a complex and multifaceted endeavor. By diversifying its portfolio and focusing on companies with strong growth potential, the government aims to achieve stable and consistent returns. As the government continues to invest in the stock market, its actions will undoubtedly have a significant impact on the market and the economy.

vanguard total stock market et