The stock market is a dynamic and complex environment, where investors can make significant gains or losses. One critical aspect of trading is understanding the premarket US stocks time, which refers to the period before the regular trading hours begin. In this article, we will delve into the importance of premarket trading, how it works, and what you need to know to make informed decisions.

What is Premarket Trading?

Premarket trading is the period when stocks are traded before the regular trading hours. This time typically begins at 4:00 AM Eastern Time and ends at 9:30 AM Eastern Time. During this period, traders can buy and sell stocks, which can impact the opening prices of stocks when the regular trading hours begin.

Why is Premarket Trading Important?

Market Movements: The premarket trading period can provide insights into the market's mood and potential movements. If a stock is performing well during premarket trading, it may open higher when regular trading hours begin. Conversely, if a stock is struggling, it may open lower.

Early Access: Premarket trading allows investors to access the market before others. This can be particularly beneficial for professional traders and institutional investors who need to react quickly to market news and events.

News and Announcements: The premarket trading period is often when important news and corporate announcements are released. Being aware of these announcements can help investors make informed decisions.

How to Access Premarket Trading?

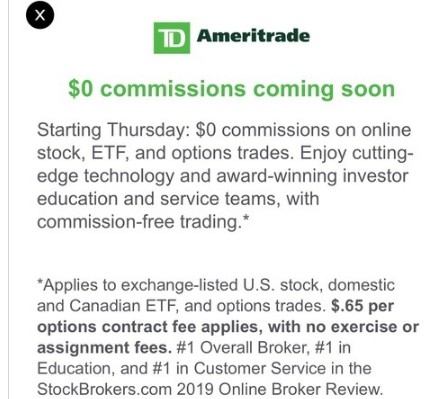

To participate in premarket trading, you will need a brokerage account that supports premarket trading. Many brokerage platforms offer this feature, allowing you to trade stocks before the regular trading hours.

Tips for Trading During Premarket

Stay Informed: Keep yourself updated with the latest market news and corporate announcements. This information can significantly impact stock prices during premarket trading.

Use Stop-Loss Orders: To protect yourself from sudden market movements, consider using stop-loss orders. This will help you limit potential losses if a stock's price moves against you.

Be Cautious: The premarket trading period can be volatile, so it's essential to be cautious with your investments. Avoid making impulsive decisions based on short-term market movements.

Case Study: Premarket Trading Impact

One notable example of the impact of premarket trading is the announcement of Apple's earnings report. In April 2021, Apple reported its quarterly earnings during the premarket trading period. The stock opened higher by more than 6% on the following day, demonstrating the influence of premarket trading on stock prices.

Conclusion

Understanding the premarket US stocks time is crucial for investors who want to stay ahead of the market. By staying informed, using the right tools, and being cautious, you can take advantage of this valuable trading period.

vanguard total stock market et