The NASDAQ Composite, a widely followed stock market index, has been a bellwether for the technology sector and the broader market. Its yearly performance is closely watched by investors, analysts, and market enthusiasts. This article delves into the NASDAQ's yearly performance, analyzing its trends, key drivers, and potential future outlook.

Understanding the NASDAQ Composite

The NASDAQ Composite is a market capitalization-weighted index that includes more than 3,000 companies. It represents a diverse range of industries, including technology, healthcare, retail, and telecommunications. The index has gained significant importance over the years, especially with the rise of technology stocks.

Yearly Performance Trends

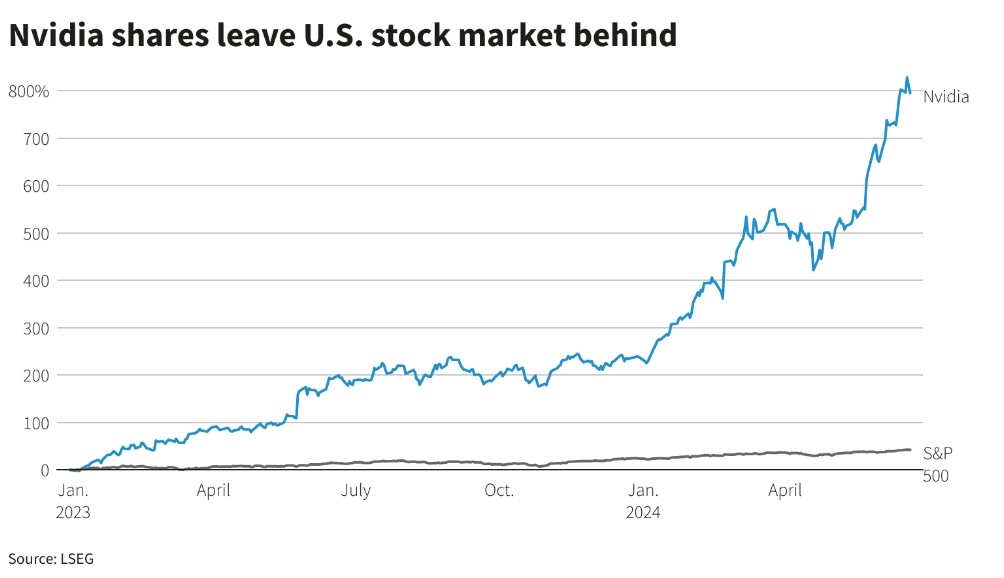

Over the past decade, the NASDAQ has exhibited strong yearly performance, often outperforming other major indices like the S&P 500. Here's a breakdown of some key trends:

- Growth Stocks Dominance: The NASDAQ has been dominated by growth stocks, particularly in the technology sector. Companies like Apple, Microsoft, and Amazon have contributed significantly to the index's growth.

- Volatility: The NASDAQ is known for its volatility, reflecting the high-risk nature of its constituent companies. This volatility can lead to significant gains or losses in a short period.

- Sector Rotation: The NASDAQ has seen sector rotation, with different sectors leading at different times. For instance, technology stocks have been dominant in recent years, while healthcare and biotech stocks have gained prominence in recent months.

Key Drivers of NASDAQ Performance

Several factors have contributed to the NASDAQ's yearly performance:

- Economic Growth: Strong economic growth, particularly in the technology sector, has been a major driver of the NASDAQ's performance. The U.S. economy has experienced robust growth over the past few years, leading to increased corporate earnings and stock prices.

- Innovation: The technology sector, which constitutes a significant portion of the NASDAQ, has been a hotbed of innovation. Companies like Tesla, Netflix, and Zoom have revolutionized their respective industries, contributing to the index's growth.

- Monetary Policy: The Federal Reserve's monetary policy has also played a role in the NASDAQ's performance. Lower interest rates and quantitative easing measures have encouraged investors to seek higher returns in riskier assets like stocks.

Case Studies

- Tesla (TSLA): Tesla has been a significant contributor to the NASDAQ's growth. The electric vehicle manufacturer has seen its stock price skyrocket, driven by strong sales and innovative technology.

- Amazon (AMZN): Amazon, the world's largest online retailer, has been a dominant force in the NASDAQ. The company has expanded its business into various sectors, including cloud computing and streaming services, contributing to its impressive growth.

Future Outlook

Looking ahead, the NASDAQ's future performance is uncertain. While the technology sector is expected to continue growing, there are several risks to consider:

- Economic Slowdown: A potential economic slowdown could impact the NASDAQ's performance, particularly if it affects the technology sector.

- Regulatory Challenges: The technology sector faces increasing regulatory scrutiny, which could impact the growth of its constituent companies.

- Market Volatility: The NASDAQ's inherent volatility means that investors should be prepared for significant price swings.

In conclusion, the NASDAQ's yearly performance has been impressive, driven by growth stocks, innovation, and favorable economic conditions. However, investors should be aware of the risks and potential challenges ahead.

vanguard total stock market et