Are you interested in investing in the US stock market but unsure of how to get started? Buying shares in the US stock market can be a great way to grow your wealth over time. In this article, we will guide you through the process of buying shares in the US stock market, step by step.

Understanding the Basics

Before diving into the process, it’s important to understand the basics of the stock market. The stock market is a place where shares of publicly traded companies are bought and sold. When you buy shares of a company, you become a partial owner of that company. The value of your shares can increase or decrease based on the company’s performance and the overall market conditions.

Choosing a Broker

The first step in buying shares in the US stock market is to choose a broker. A broker is a person or firm that acts as an intermediary between you and the stock market. They will execute your trades and provide you with access to the market.

There are many brokers to choose from, so it’s important to do your research. Consider factors such as fees, customer service, and the types of investments they offer. Some popular brokers include Fidelity, Charles Schwab, and TD Ameritrade.

Opening an Account

Once you have chosen a broker, the next step is to open an account. This process typically involves filling out an application and providing some personal information, such as your name, address, and Social Security number. You may also need to provide proof of identity and address.

Some brokers may require you to deposit a minimum amount of money into your account before you can start trading. This amount can vary depending on the broker and the type of account you open.

Researching Stocks

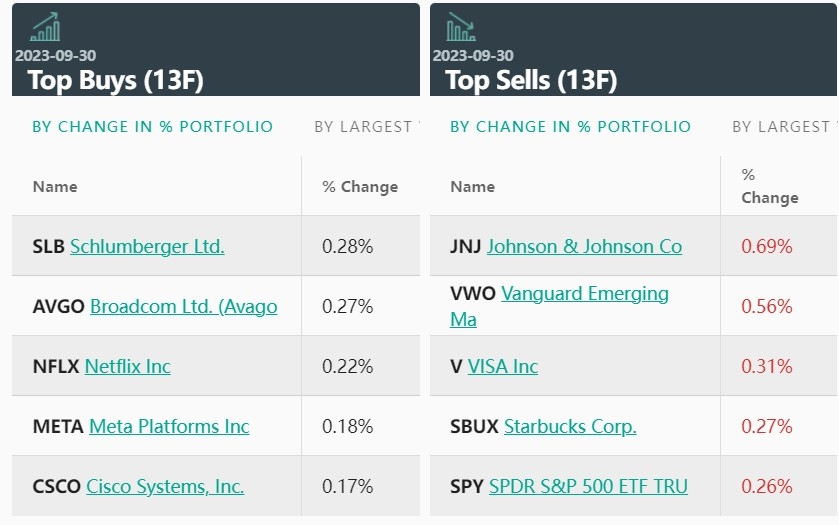

Before buying shares, it’s important to research the companies you are interested in. Look at their financial statements, earnings reports, and other relevant information to get a sense of their performance and future prospects.

You can use a variety of tools to research stocks, including financial websites, stock market apps, and investment newsletters. Some popular resources include Yahoo Finance, Google Finance, and Motley Fool.

Placing an Order

Once you have chosen a stock, it’s time to place an order. There are two types of orders you can place: a market order and a limit order.

A market order is an order to buy or sell a stock at the best available price. A limit order is an order to buy or sell a stock at a specific price or better.

It’s important to understand the difference between these two types of orders, as they can affect the price you pay or receive for your shares.

Monitoring Your Investments

After you have bought shares, it’s important to monitor your investments. Keep an eye on the company’s performance and the overall market conditions. If you notice any red flags, such as declining earnings or increased debt, you may want to consider selling your shares.

Remember that investing in the stock market involves risk, and it’s important to diversify your portfolio to minimize your risk.

Case Study: Apple Inc.

Let’s say you want to buy shares of Apple Inc. (AAPL). After researching the company, you decide that it is a good investment. You open an account with a broker, deposit the minimum amount of money required, and place a market order to buy 100 shares of Apple.

A few months later, the value of your shares has increased, and you decide to sell them. You place a limit order to sell your shares at a specific price, ensuring that you receive the best possible price.

By following these steps, you can successfully buy shares in the US stock market and potentially grow your wealth over time.

vanguard total stock market et