In the world of finance, the Dow Jones Industrial Average (DJIA) is one of the most recognized indices. But how does it stack up against other major indices? In this article, we'll delve into the DJIA and compare it with other prominent indices to provide a comprehensive overview of their performance, characteristics, and implications.

Understanding the Dow Jones Industrial Average

The Dow Jones Industrial Average, often simply referred to as the "Dow," is a stock market index that tracks the share prices of 30 large, publicly-owned companies in the United States. These companies represent a diverse range of industries, including finance, technology, and healthcare. The DJIA has been around since 1896 and is widely regarded as a bellwether for the U.S. stock market.

Comparison with the S&P 500

The S&P 500 is another widely followed index, but it differs from the DJIA in several key aspects. The S&P 500 includes the stocks of 500 large companies, covering a broader range of industries than the DJIA. This makes the S&P 500 a more representative indicator of the overall U.S. stock market.

One of the main differences between the two indices is the method of calculation. The DJIA is a price-weighted index, meaning that the stock with the highest price has the most influence on the index's value. In contrast, the S&P 500 is a market-cap-weighted index, which means that the index reflects the total market value of the companies in the index.

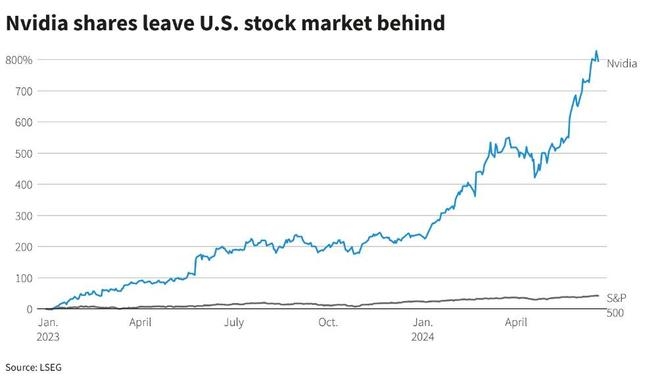

Performance Comparison

When it comes to performance, both the DJIA and the S&P 500 have shown strong growth over the years. However, there have been instances where one index outperformed the other. For example, during the 2008 financial crisis, the DJIA experienced a more significant decline than the S&P 500, due to its price-weighted nature.

On the other hand, the S&P 500 has often outperformed the DJIA in the long term. This is primarily because the S&P 500 is a broader index that includes more companies, which can provide a more diverse and balanced view of the market.

Case Study: Technology Sector Performance

One of the most notable differences between the DJIA and the S&P 500 is the technology sector. The DJIA includes only one technology company, whereas the S&P 500 includes several technology giants such as Apple, Microsoft, and Amazon.

This difference in composition has had a significant impact on the performance of the two indices. For example, during the tech boom of the late 1990s, the S&P 500 outperformed the DJIA, largely due to the strong performance of technology stocks.

Conclusion

In conclusion, the Dow Jones Industrial Average and the S&P 500 are both important indices that provide valuable insights into the U.S. stock market. While the DJIA is a price-weighted index that includes 30 large companies, the S&P 500 is a market-cap-weighted index that covers 500 companies across various industries. Both indices have their strengths and weaknesses, and their performance can vary depending on market conditions and sector-specific trends. Understanding these differences can help investors make informed decisions when it comes to investing in the U.S. stock market.

vanguard total stock market et