The stock market has always been a reflection of the economic landscape. As of late, the phrase "all us stocks down" has become increasingly common, raising questions among investors and the public alike. In this article, we'll delve into the reasons behind this trend, its implications for investors, and potential strategies for navigating this volatile market.

The Market Decline: A Closer Look

Several factors have contributed to the recent downward trend in the stock market. Here are some of the key reasons:

Global Economic Uncertainty: The ongoing trade disputes between the United States and China have caused market turmoil. Investors are concerned about the potential impact of tariffs on global trade and economic growth.

Corporate Profits: Many companies are experiencing lower profits due to increased costs and slower economic growth. This has led to a decrease in share prices.

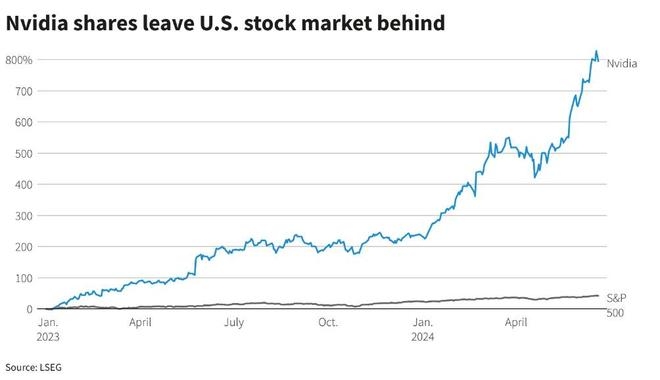

Technological Stock Declines: The decline in major technology stocks has had a significant impact on the broader market. Fears of increased regulation and a potential economic slowdown have led to a sell-off in tech stocks.

Implications for Investors

The current market decline has several implications for investors:

Risk Management: It's crucial for investors to reassess their risk tolerance. Those with a higher risk tolerance may find opportunities in this volatile market, while conservative investors may want to focus on more stable investments.

Diversification: Diversification is key to protecting your portfolio during market downturns. Investing in a mix of asset classes, such as stocks, bonds, and real estate, can help mitigate risks.

Long-Term Perspective: It's essential to maintain a long-term perspective when investing in the stock market. Short-term market fluctuations can be unpredictable, but a well-diversified portfolio can weather the storm.

Strategies for Navigating the Market

Here are some strategies that investors can consider to navigate the current market decline:

Rebalance Your Portfolio: Review your portfolio regularly and make adjustments as needed. This can help ensure that your investments align with your risk tolerance and investment goals.

Consider Dividend Stocks: Dividend-paying stocks can provide income and stability during market downturns. Companies with strong financial health and a history of increasing dividends can be good options.

Look for Undervalued Stocks: Identify undervalued stocks that have the potential to recover. This requires thorough research and a willingness to take on more risk.

Case Study: Amazon's Decline

One of the most notable examples of the current market decline is the fall in Amazon's stock price. The tech giant has faced a combination of factors, including increased competition, higher costs, and concerns about regulation. Despite this, many investors remain bullish on the company, as they believe its long-term growth prospects remain strong.

In conclusion, the current trend of "all us stocks down" is a complex issue with several underlying factors. By understanding these reasons and their implications, investors can make informed decisions to protect and grow their portfolios. Remember to stay informed, diversify your investments, and maintain a long-term perspective.

vanguard total stock market et