In an era where geopolitical tensions and cybersecurity threats loom large, investing in US national security stocks has become a compelling strategy for investors seeking stability and growth. These stocks represent companies that play a crucial role in safeguarding the nation's interests, from defense to cybersecurity. This article delves into the key aspects of US national security stocks, providing insights into their potential and risks.

Understanding US National Security Stocks

US national security stocks encompass a diverse range of industries, including defense, aerospace, cybersecurity, and intelligence. These companies are vital to the nation's defense and security, providing essential services and technologies. Key sectors within this category include:

- Defense Contractors: Companies like Lockheed Martin and Raytheon Technologies that design, develop, and produce military equipment and systems.

- Aerospace and Defense Suppliers: Organizations like Northrop Grumman and General Dynamics, which supply components and services to the aerospace and defense industry.

- Cybersecurity Firms: Companies like FireEye and Crowdstrike that specialize in protecting critical infrastructure and data from cyber threats.

- Intelligence and Surveillance Companies: Organizations like Leidos and Booz Allen Hamilton that provide intelligence, analysis, and cybersecurity services to government agencies.

Benefits of Investing in US National Security Stocks

Investing in US national security stocks offers several advantages:

- Stable Revenue Streams: These companies often have long-term contracts with government agencies, ensuring consistent revenue streams.

- Growth Potential: As geopolitical tensions rise, demand for national security products and services is likely to increase, offering significant growth potential.

- Diversification: Investing in this sector can provide diversification to a portfolio, as it is less correlated with broader market fluctuations.

Risks to Consider

While investing in US national security stocks offers numerous benefits, it is crucial to be aware of the associated risks:

- Political Risk: Changes in government policies or defense budgets can impact the revenue and profitability of these companies.

- Cybersecurity Threats: As these companies are targets for cyber attacks, they face the risk of data breaches and other security incidents.

- Competition: The defense and cybersecurity industries are highly competitive, which can lead to pricing pressures and reduced margins.

Case Studies: Successful US National Security Stocks

Several US national security stocks have demonstrated impressive performance over the years. For instance:

- Lockheed Martin: As the world's largest defense contractor, Lockheed Martin has consistently delivered strong financial results, driven by its diverse portfolio of defense and aerospace products.

- Northrop Grumman: This company has expanded its presence in the cybersecurity market, leading to significant growth in recent years.

- Crowdstrike: As a leading cybersecurity firm, Crowdstrike has experienced rapid growth, driven by increasing demand for its services.

Conclusion

Investing in US national security stocks can be a wise decision for investors seeking stability and growth. By understanding the key sectors and risks, investors can make informed decisions and potentially reap significant returns. However, it is crucial to conduct thorough research and consider the unique risks associated with this sector.

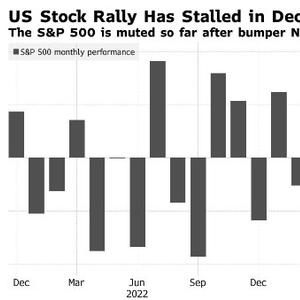

us stock market today