As we dive into the heart of August 2025, the US stock market finds itself at a pivotal juncture. The market sentiment is a complex tapestry woven with threads of economic data, geopolitical events, and investor expectations. This article delves into the current market sentiment surrounding US stocks, analyzing the factors that are shaping the landscape and offering insights into potential future trends.

Economic Indicators and Stock Market Performance

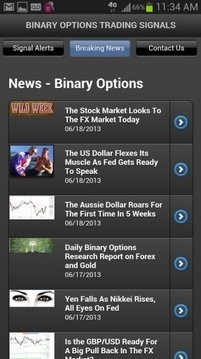

Economic indicators continue to play a crucial role in shaping market sentiment. In August 2025, the US economy is expected to be on a steady growth trajectory, with a focus on key indicators such as unemployment rates, inflation, and GDP growth. The Federal Reserve's monetary policy decisions are closely watched, as they can significantly impact market sentiment.

Unemployment Rates and Consumer Spending

Unemployment rates have been steadily declining, reaching pre-pandemic levels. This positive trend has been a major driver of market sentiment, as lower unemployment rates often lead to increased consumer spending. Companies in sectors like retail, consumer goods, and services are likely to benefit from this trend, as consumer confidence remains robust.

Inflation and Interest Rates

Inflation remains a key concern for investors. While the Consumer Price Index (CPI) has shown signs of moderation, it remains above the Federal Reserve's target of 2%. The Federal Reserve's response to inflation is closely watched, as interest rate hikes can have a significant impact on the stock market. Companies with high debt levels or those sensitive to interest rate changes may face increased borrowing costs and reduced profitability.

Geopolitical Events and Market Sentiment

Geopolitical events continue to play a pivotal role in shaping market sentiment. In August 2025, tensions in certain regions of the world are likely to remain a concern for investors. These tensions can lead to increased volatility in the stock market, as investors react to news and events.

Sector Performance and Stock Market Trends

In August 2025, certain sectors are expected to outperform others. Technology and healthcare companies are likely to be in focus, driven by strong fundamentals and growth prospects. On the other hand, sectors like energy and financials may face challenges due to economic and regulatory factors.

Case Study: Tech Giant Apple

A prime example of a company that has been able to navigate the current market sentiment is Apple Inc. Despite the challenges posed by global supply chain disruptions and geopolitical tensions, Apple has continued to deliver strong financial results. The company's focus on innovation and expansion into new markets has helped it maintain its position as a market leader.

Conclusion

The current market sentiment surrounding US stocks in August 2025 is shaped by a complex interplay of economic indicators, geopolitical events, and investor expectations. While challenges remain, the overall outlook remains positive, with opportunities for growth and investment in various sectors. As always, investors should stay informed and make decisions based on thorough research and analysis.

us stock market today