Are you interested in trading US stock options but unsure about how to do it from India? Trading stock options is a sophisticated investment strategy that allows you to speculate on the price movements of a stock. However, navigating the regulatory landscape and ensuring compliance with Indian and US regulations can be challenging. This guide will help you understand the process and key considerations when trading US stock options from India.

Understanding Stock Options

Before diving into trading, it's essential to understand what stock options are. A stock option is a financial contract that gives the owner the right, but not the obligation, to buy or sell a stock at a predetermined price within a specific time frame. There are two types of stock options: call options and put options.

- Call options give the owner the right to buy the underlying stock at the strike price before the expiration date.

- Put options give the owner the right to sell the underlying stock at the strike price before the expiration date.

Choosing a Broker

To trade US stock options from India, you'll need to find a reputable broker that supports international trading. Here are some key factors to consider when choosing a broker:

- Regulatory Compliance: Ensure the broker is registered with the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

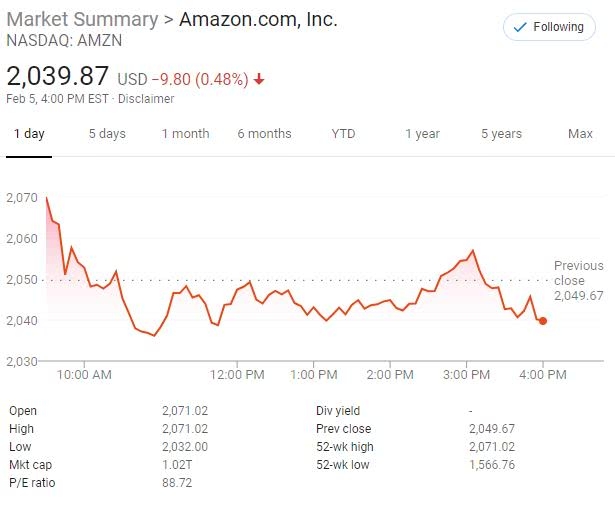

- Platform Features: Look for a broker that offers a user-friendly platform with access to real-time market data and analytics.

- Fees and Commissions: Compare fees and commissions to ensure you're getting the best deal.

Example: TD Ameritrade is a well-regarded broker that supports international trading and offers a range of platform features and competitive fees.

Opening an Account

Once you've chosen a broker, the next step is to open an account. Here's what you'll need to do:

- Fill out the application form: Provide your personal and financial information, including your address in India.

- Provide identification documents: Submit a copy of your passport, driver's license, or other government-issued ID.

- Deposit funds: Transfer funds from your Indian bank account to your trading account.

Navigating Indian and US Regulations

Trading US stock options from India requires understanding and complying with both Indian and US regulations. Here are some key points to keep in mind:

- Capital Gains Tax: If you earn a profit from trading stock options, you may be subject to capital gains tax in India. Consult with a tax professional to understand your tax obligations.

- Exchange Rate Risk: The exchange rate between the Indian rupee and the US dollar can impact your profits. Be aware of the potential for currency fluctuations.

- Regulatory Compliance: Ensure you're following all regulations set by the SEC, FINRA, and the Reserve Bank of India (RBI).

Developing a Trading Strategy

Trading stock options requires a well-defined strategy. Here are some tips to help you get started:

- Research the market: Understand the fundamentals of the stocks you're interested in trading.

- Use technical analysis: Analyze price charts and other indicators to identify potential trading opportunities.

- Manage risk: Set stop-loss orders to limit your potential losses.

- Stay disciplined: Stick to your trading plan and avoid making impulsive decisions.

Conclusion

Trading US stock options from India can be a lucrative investment strategy, but it requires careful planning and compliance with regulations. By choosing a reputable broker, opening an account, understanding regulations, and developing a solid trading strategy, you can successfully navigate the complex world of stock options.

us stock market live