Introduction

As we delve into the latter half of 2025, the US stock market continues to captivate investors and analysts alike. While many herald it as a golden age of growth, there are several counterarguments that suggest the market may be due for a downturn. This article aims to explore these contrasting views, providing a balanced perspective on the current trends.

1. The Market's Overvaluation

One of the most prominent counterarguments is the market's overvaluation. Despite the strong performance over the past few years, many experts argue that the stock market is currently overvalued. A key indicator of this is the Shiller P/E ratio, which has been consistently higher than its long-term average. This suggests that investors are paying too much for the companies they are buying, potentially leading to a correction in the future.

Case Study: Tech Sector

The tech sector, which has been a major driver of the market's growth, is a prime example of this overvaluation. Companies like Apple, Amazon, and Google have seen their stock prices soar, but many investors question whether these valuations are justified. For instance, Apple's market capitalization has reached an all-time high, raising concerns about whether it can continue to grow at its current pace.

2. Economic Concerns

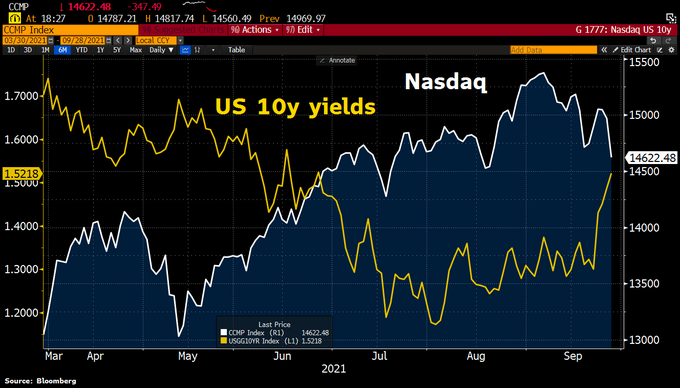

Another counterargument revolves around economic concerns. While the US economy has been growing steadily, there are signs of potential trouble ahead. Factors such as rising interest rates, inflation, and geopolitical tensions have raised concerns about the market's future performance. These issues could lead to a slowdown in economic growth, which could, in turn, impact the stock market.

Case Study: Inflation and the Stock Market

One of the most significant economic concerns is inflation. As the cost of living continues to rise, consumers may have less disposable income to spend on goods and services, potentially impacting the profits of companies. This could lead to a decline in stock prices as investors become more cautious.

3. Valuation Metrics

In addition to the Shiller P/E ratio, other valuation metrics also suggest that the market is overvalued. For instance, the CAPE ratio, which is another measure of stock market valuation, has been above its historical average for several years. This indicates that investors may be paying too much for the companies they are buying, setting the stage for a potential correction.

4. Market Volatility

Another counterargument to the current market trends is the increased volatility. While the market has experienced periods of strong growth, it has also seen periods of significant volatility. This volatility could indicate that the market is becoming more speculative, with investors taking on more risk in search of higher returns. This could lead to a sudden downturn if market sentiment shifts.

Conclusion

While the US stock market has been performing well in recent years, there are several counterarguments that suggest the market may be due for a downturn. These include the market's overvaluation, economic concerns, valuation metrics, and market volatility. As investors navigate the current market trends, it is important to consider these counterarguments and remain vigilant about potential risks.

us stock market live