In recent years, the US-China relationship has been a hot topic in the global financial community. As the world's two largest economies, the United States and China have a significant impact on each other's markets. One of the most significant areas of this relationship is the investment in Chinese stocks. However, the impact of US taxes on these investments cannot be overlooked. This article will explore how US taxes are affecting investments in Chinese stocks and the potential implications for investors.

Understanding the Tax Implications

When investing in Chinese stocks, US investors must consider the tax implications. The United States has a complex tax system, and the tax treatment of international investments can be particularly confusing. Here are some key points to consider:

Withholding Tax: The United States has an agreement with China that requires a 10% withholding tax on dividends paid to US investors. This means that only 90% of the dividend income is subject to US tax.

Capital Gains Tax: When selling Chinese stocks, US investors must pay capital gains tax on the profit. The rate depends on the holding period of the investment. Short-term gains are taxed at the investor's ordinary income rate, while long-term gains are taxed at a lower rate.

Form 8938: US investors with foreign financial assets exceeding certain thresholds must file Form 8938 with the IRS. Failure to comply can result in penalties.

Impact on Investment Decisions

The tax implications of investing in Chinese stocks can significantly impact investment decisions. Here are some ways in which US taxes are affecting these investments:

Lower Dividend Income: The 10% withholding tax on dividends can reduce the actual return on investment. This may discourage some investors from investing in Chinese stocks.

Capital Gains Tax Considerations: The potential for capital gains tax can also affect investment decisions. Investors may be hesitant to invest in Chinese stocks if they expect to incur significant taxes upon selling.

Reporting Requirements: The requirement to file Form 8938 can be burdensome for some investors. This may lead to a reluctance to invest in Chinese stocks due to the administrative hassle.

Case Studies

To illustrate the impact of US taxes on investments in Chinese stocks, let's consider two hypothetical scenarios:

Investor A: This investor holds a Chinese stock for five years and earns a profit of

10,000 upon selling. Assuming a 20% capital gains tax rate, the investor would pay 2,000 in taxes. However, the 10% withholding tax on dividends would reduce the actual return on investment.Investor B: This investor holds a Chinese stock for two years and earns a profit of

5,000 upon selling. Assuming a 37% capital gains tax rate, the investor would pay 1,850 in taxes. The 10% withholding tax on dividends would further reduce the return on investment.

Conclusion

In conclusion, US taxes have a significant impact on investments in Chinese stocks. The 10% withholding tax on dividends, capital gains tax, and reporting requirements can all affect investment decisions. While investing in Chinese stocks offers potential opportunities, investors must carefully consider the tax implications before making their decisions. As the US-China relationship continues to evolve, it's crucial for investors to stay informed about the tax landscape and adapt their strategies accordingly.

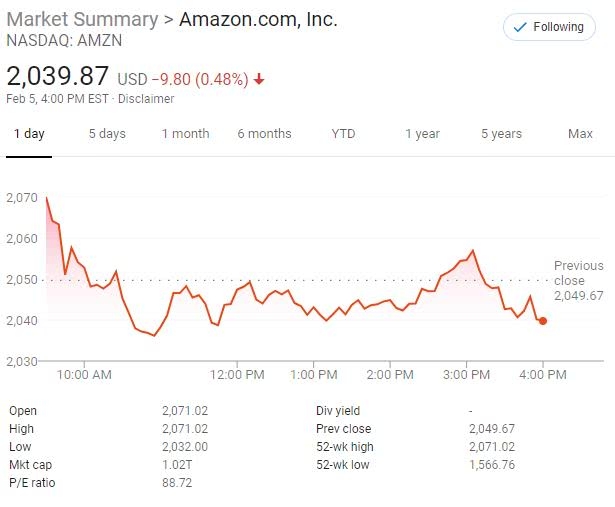

us stock market live