Understanding how stock dividends are taxed in the United States is crucial for investors and individuals looking to maximize their returns on investments. Stock dividends represent a portion of a company's profits distributed to its shareholders. While they can be a significant source of income, the way they are taxed can vary depending on several factors. In this article, we'll delve into the basics of stock dividend taxation in the US and provide some insights into how you can effectively manage your tax liabilities.

What Are Stock Dividends?

Firstly, let's clarify what stock dividends are. When a company earns profits, it can choose to distribute a portion of these profits to its shareholders as dividends. These dividends can be in the form of cash, additional shares of stock, or a combination of both. The key thing to remember is that dividends are a return on investment for shareholders and are typically taxed differently from other types of income.

Taxation of Stock Dividends

In the US, the taxation of stock dividends is generally subject to capital gains tax. Here's how it works:

Qualified Dividends: If the dividends you receive are classified as qualified dividends, they will be taxed at a lower rate than non-qualified dividends. Qualified dividends are usually those paid by US corporations and meet certain requirements set by the IRS. For tax year 2022, qualified dividends are taxed at a maximum rate of 20%, which is lower than the ordinary income tax rates.

Non-Qualified Dividends: Non-qualified dividends are taxed at your ordinary income tax rate, which can vary depending on your overall income level. For example, if you are in the 22% tax bracket, non-qualified dividends will be taxed at that rate.

To determine whether a dividend is qualified or non-qualified, you'll need to review the Form 1099-DIV you receive from your brokerage firm. This form will indicate whether the dividends you received are qualified or non-qualified.

Reporting Dividend Income

It's important to report dividend income accurately on your tax return. This is done by filling out Schedule B of Form 1040 and reporting the total amount of dividends you received during the year. If you received qualified dividends, you will also need to complete Form 8949 and Schedule D to calculate your capital gains or losses.

Case Study: Taxation of Stock Dividends

Let's consider an example to illustrate how stock dividends are taxed:

John owns 100 shares of XYZ Corporation, which pays a quarterly dividend of

Tax Planning for Stock Dividends

To optimize your tax situation when it comes to stock dividends, consider the following strategies:

Invest in Dividend-Paying Stocks: Investing in dividend-paying stocks can provide a steady stream of income while benefiting from potential capital gains if the stock's price increases.

Harvesting Capital Gains: If you have capital gains from selling stocks, consider receiving qualified dividends to offset some of those gains.

Diversify Your Portfolio: Diversifying your portfolio can help mitigate the impact of tax liabilities on stock dividends.

In conclusion, understanding how stock dividends are taxed in the US is essential for investors looking to optimize their tax liabilities and maximize their returns. By familiarizing yourself with the rules and regulations surrounding qualified and non-qualified dividends, you can make informed decisions about your investments.

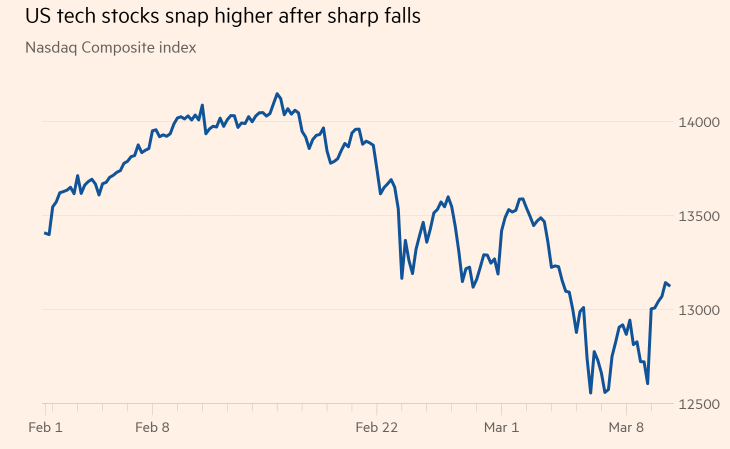

us stock market live