Investing across borders can be an exciting and lucrative venture. For Canadian investors, looking towards the United States for investment opportunities can be particularly rewarding. The US stock market is the largest in the world, offering a wide range of investment options. In this article, we'll explore the benefits and considerations of Canadian investing in US stocks, providing you with the knowledge to make informed decisions.

Understanding the US Stock Market

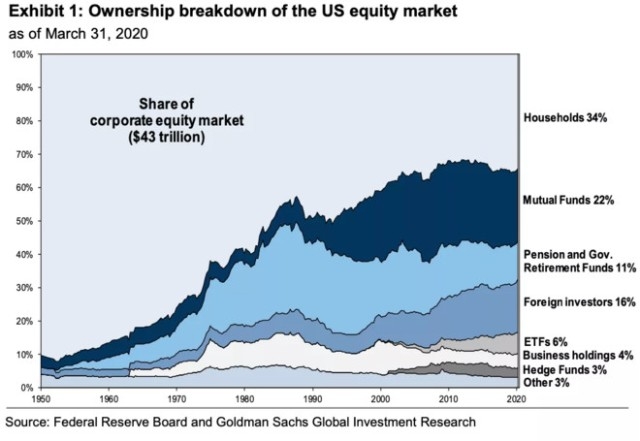

The US stock market is home to some of the world's most successful and well-known companies. The S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite are just a few of the major indices that track the performance of US stocks. Investing in these indices can provide Canadian investors with access to a diverse range of industries and sectors.

Benefits of Investing in US Stocks

- Market Size and Diversity: The US stock market is vast, offering a wide array of investment opportunities across various industries and sectors.

- Strong Regulatory Framework: The US has one of the most robust regulatory frameworks in the world, ensuring investor protection and market integrity.

- Potential for High Returns: The US stock market has historically offered higher returns than other markets, making it an attractive destination for Canadian investors.

- Currency Exchange: Investing in US stocks allows Canadian investors to potentially benefit from a strong Canadian dollar, which could increase their returns when converted back to CAD.

How to Invest in US Stocks from Canada

- Brokerage Accounts: To invest in US stocks, Canadian investors need a brokerage account that supports international trading. Many Canadian brokerage firms offer this service, allowing investors to trade US stocks directly.

- Currency Conversion: When purchasing US stocks, Canadian investors will need to consider currency conversion fees and exchange rates.

- Research and Due Diligence: It's crucial to conduct thorough research and due diligence before investing in any stock, including those in the US market.

Risk Considerations

While investing in US stocks can be beneficial, it's important to be aware of the potential risks:

- Currency Risk: Fluctuations in exchange rates can impact the value of your investment when converted back to CAD.

- Market Volatility: The US stock market, like any other market, can be volatile, leading to significant price swings.

- Regulatory Differences: Understanding and navigating the differences between Canadian and US regulations is essential for successful investing.

Case Study: Investing in US Tech Stocks

One popular area of the US stock market is technology. Canadian investors looking to diversify their portfolios may consider investing in US tech stocks. Companies like Apple, Microsoft, and Google have demonstrated strong performance and growth potential. However, it's crucial to conduct thorough research and understand the risks associated with these high-growth stocks.

Conclusion

Canadian investing in US stocks can be a wise decision for those looking to diversify their portfolios and benefit from the strengths of the US market. By understanding the benefits and risks, conducting thorough research, and using the right brokerage firm, Canadian investors can make informed decisions and potentially achieve high returns.

us stock market live