The term "US stock bear" has been on the lips of investors and financial analysts alike in recent times. A bear market is characterized by a sustained decline in stock prices, often signaling a broader economic downturn. This article delves into the current state of the US stock market, examines key factors contributing to the bearish trend, and offers insights for investors looking to navigate this challenging environment.

Understanding the Bear Market

A bear market is typically defined as a period when the stock market falls by 20% or more from its most recent peak. The current US stock market has indeed been experiencing such conditions, with several factors contributing to the bearish trend.

Key Factors Contributing to the Bear Market

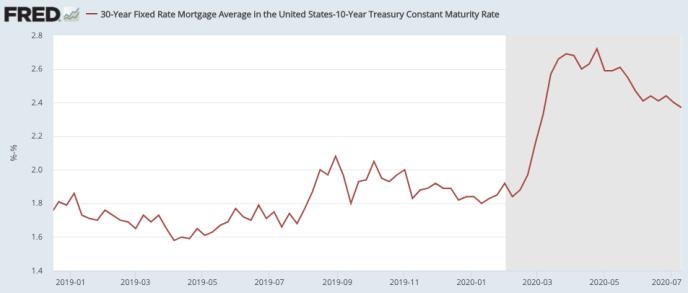

Interest Rate Hikes by the Federal Reserve: The Federal Reserve has been increasing interest rates in an attempt to curb inflation. Higher interest rates make borrowing more expensive, which can negatively impact corporate earnings and consumer spending, leading to a decline in stock prices.

Economic Slowdown: There are concerns about a potential economic slowdown, with signs of slowing economic growth in various sectors. This has raised fears of a recession, which can further drive down stock prices.

Inflation Concerns: High inflation has been a major concern for investors, as it erodes purchasing power and can lead to lower corporate profits. The Federal Reserve's efforts to combat inflation have contributed to the current bear market conditions.

Supply Chain Disruptions: The ongoing supply chain disruptions have caused disruptions in global trade, leading to higher costs for businesses and inflationary pressures.

Geopolitical Tensions: Tensions between major economies, such as the US and China, have also contributed to market uncertainty and volatility.

Navigating the Bear Market

Despite the challenging market conditions, there are strategies investors can employ to navigate the bear market:

Diversify Your Portfolio: Diversification can help reduce risk by spreading investments across different asset classes, sectors, and geographical regions.

Focus on Quality Stocks: Investing in high-quality companies with strong fundamentals can provide some level of protection against market downturns.

Stay Disciplined: It's important to stick to your investment strategy and avoid making impulsive decisions based on short-term market movements.

Consider Dividend Stocks: Dividend-paying stocks can provide a source of income during bear market conditions.

Review Your Portfolio Regularly: Regularly reviewing your portfolio can help ensure that it remains aligned with your investment goals and risk tolerance.

Case Study: Apple Inc.

One case study worth examining during the current bear market is Apple Inc. Despite the broader market downturn, Apple's stock has held up relatively well. This can be attributed to the company's strong fundamentals, including its diverse product portfolio, robust financial performance, and strong brand reputation.

In conclusion, the US stock bear market presents challenges, but it also offers opportunities for investors with a long-term perspective. By understanding the key factors contributing to the bear market and employing sound investment strategies, investors can navigate this challenging environment and potentially benefit from future market recoveries.

us energy stock