Introduction: The stock market is a complex entity that can significantly impact various aspects of the global economy. One such aspect is the value of the US dollar in the foreign exchange market. In this article, we will explore the relationship between the stock market and the US dollar exchange rate, highlighting the factors that influence this correlation.

Understanding the Correlation: The stock market and the US dollar exchange rate have a symbiotic relationship. When the stock market performs well, it often leads to an increase in the value of the US dollar, and vice versa. This correlation can be attributed to several factors:

Investor Sentiment: Investors often look to the stock market for guidance on the overall health of the economy. A strong stock market typically indicates confidence in the economy, leading to an increased demand for the US dollar. Conversely, a weak stock market can erode investor confidence, leading to a decrease in the value of the US dollar.

Interest Rates: The Federal Reserve, the central banking system of the United States, sets interest rates. Higher interest rates can attract foreign investors, as they seek higher returns on their investments. This increased demand for the US dollar can lead to an appreciation in its value. Conversely, lower interest rates can discourage foreign investment, leading to a depreciation of the US dollar.

Economic Indicators: Economic indicators, such as GDP growth, employment rates, and inflation, can influence the stock market and, in turn, the US dollar exchange rate. Positive economic indicators can boost the stock market and the US dollar, while negative indicators can have the opposite effect.

Case Studies:

2008 Financial Crisis: During the 2008 financial crisis, the stock market plummeted, leading to a significant depreciation of the US dollar. Investors sought safer assets, such as US government bonds, which further weakened the dollar.

2020 Pandemic: The COVID-19 pandemic caused a sharp decline in the stock market, resulting in a depreciation of the US dollar. However, as the pandemic situation improved and vaccination rates increased, the stock market recovered, and the US dollar appreciated.

Conclusion: In conclusion, the stock market and the US dollar exchange rate are closely intertwined. While the correlation is not always straightforward, it is clear that the stock market can have a significant impact on the value of the US dollar. Understanding this relationship can help investors make informed decisions and navigate the complex world of global finance.

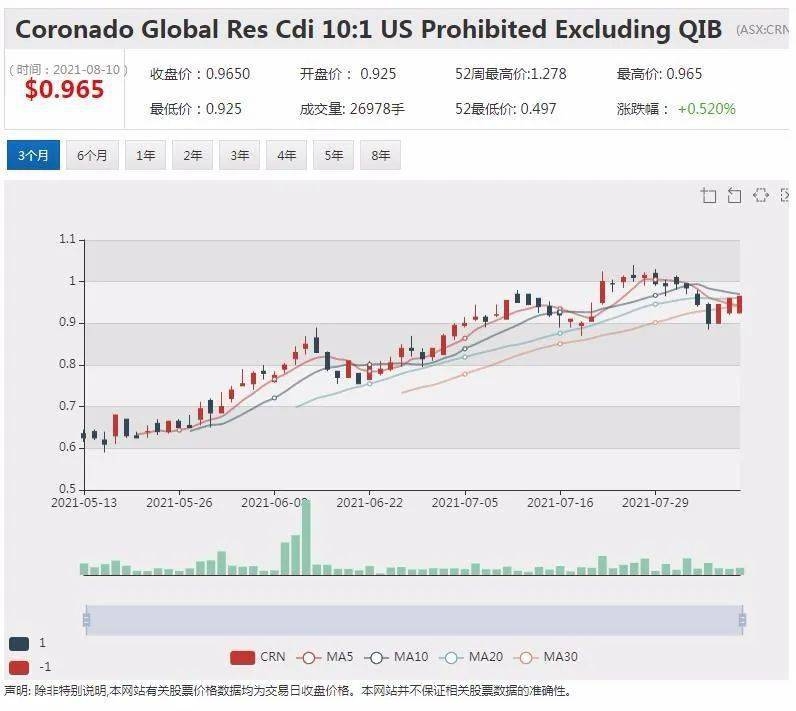

us energy stock