In the dynamic world of the stock market, dividends can be a significant indicator of a company's financial health and stability. The year 2018 saw several U.S. stocks delivering impressive dividend yields, making them attractive investments for income-seekers. This article highlights some of the top dividend-paying U.S. stocks from 2018, offering insights into their performance and potential for future returns.

Exxon Mobil Corporation (XOM)

Exxon Mobil, one of the largest oil and gas companies in the world, topped the list of dividend-paying stocks in 2018. The company, known for its robust dividend yield, increased its payout for the 35th consecutive year. With a dividend yield of over 3%, Exxon Mobil offered investors a reliable source of income amidst the volatility of the energy sector.

Johnson & Johnson (JNJ)

Johnson & Johnson, a diversified healthcare company, was another top performer in terms of dividends in 2018. Known for its strong presence in pharmaceuticals, consumer health, and medical devices, JNJ offered a dividend yield of approximately 2.7%. The company's consistent performance and commitment to shareholder returns made it a favorite among dividend investors.

Procter & Gamble (PG)

Procter & Gamble, a leader in consumer goods, also featured prominently in the list of top dividend stocks in 2018. With a dividend yield of around 3%, P&G continued to reward shareholders with its reliable and increasing dividend payments. The company's diverse product portfolio and global reach contributed to its stable performance and attractive dividend yield.

Walmart Inc. (WMT)

Walmart, the world's largest retailer, was not far behind in terms of dividend performance in 2018. Offering a dividend yield of approximately 2.6%, Walmart's dividend payout was supported by its strong market position and efficient operations. The company's commitment to increasing its dividend payments over the years made it a staple in many dividend investor portfolios.

Visa Inc. (V)

In the financial sector, Visa Inc. stood out as a top dividend stock in 2018. With a dividend yield of about 1.5%, Visa's dividend payout was supported by its robust revenue growth and strong financial performance. The company's position as a global payments network continued to attract investors seeking stable income and growth potential.

Case Study: Microsoft Corporation (MSFT)

While not among the top dividend yielders in 2018, Microsoft Corporation's dividend performance was noteworthy. The tech giant increased its dividend by 10% in 2018, reflecting its commitment to returning value to shareholders. Microsoft's dividend yield of around 1.6% may not have been the highest, but the company's consistent dividend growth and strong fundamentals made it a top pick for long-term investors.

Conclusion

The top dividend-paying U.S. stocks in 2018 showcased the diverse sectors and industries that offer attractive dividend yields. From energy and healthcare to consumer goods and financial services, these companies demonstrated their ability to generate consistent and reliable income for shareholders. As investors look to 2019 and beyond, these sectors and companies remain compelling options for those seeking stable dividend returns.

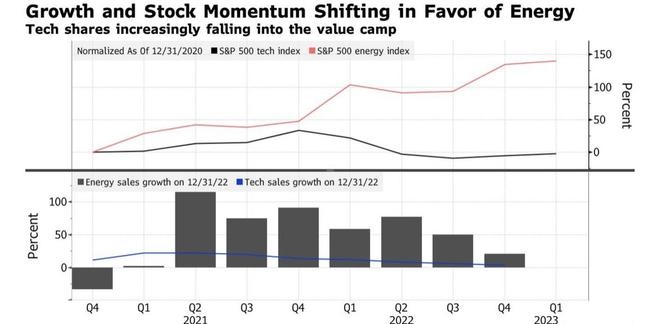

us energy stock