Investing in the stock market can be a thrilling and potentially lucrative venture. However, finding the right stocks to invest in can be daunting, especially for beginners. That's where understanding the concept of "optionable US stocks" comes into play. This guide will provide you with a comprehensive list of optionable US stocks and essential information to help you make informed investment decisions.

What Are Optionable Stocks?

Optionable stocks are those that can be traded as options contracts. Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price within a specific time frame. These assets can be stocks, indices, bonds, commodities, or currencies. When a stock is optionable, it means investors can create various strategies to manage risk or capitalize on market movements.

Top 10 Optionable US Stocks to Watch

Apple Inc. (AAPL) - As one of the most popular tech companies, Apple offers a wide range of options contracts. Its strong fundamentals and consistent dividend payments make it a favorite among investors.

Microsoft Corporation (MSFT) - With its dominant position in the software industry, Microsoft provides a solid investment opportunity for options traders.

Amazon.com Inc. (AMZN) - As the largest e-commerce company in the world, Amazon's stock has significant potential for growth. Its optionable nature allows investors to take advantage of its volatile price movements.

Google parent Alphabet Inc. (GOOGL) - Alphabet's diversified business portfolio and its leadership in the tech industry make it a compelling optionable stock.

Facebook parent Meta Platforms Inc. (META) - Meta is a key player in the social media and virtual reality space. Its optionable nature allows investors to capitalize on its rapid growth and potential for volatility.

Tesla Inc. (TSLA) - As the leading electric vehicle manufacturer, Tesla's stock is highly volatile and offers exciting opportunities for options trading.

Intel Corporation (INTC) - With its focus on the semiconductor industry, Intel has a strong track record and potential for growth.

NVIDIA Corporation (NVDA) - NVIDIA is a leading player in the graphics processing unit (GPU) market, and its stock is known for its significant price swings.

Johnson & Johnson (JNJ) - As a diversified healthcare company, Johnson & Johnson offers stability and potential growth, making it an attractive optionable stock.

Procter & Gamble (PG) - P&G is a global consumer goods giant with a strong brand presence and a history of consistent growth.

Key Considerations When Trading Optionable Stocks

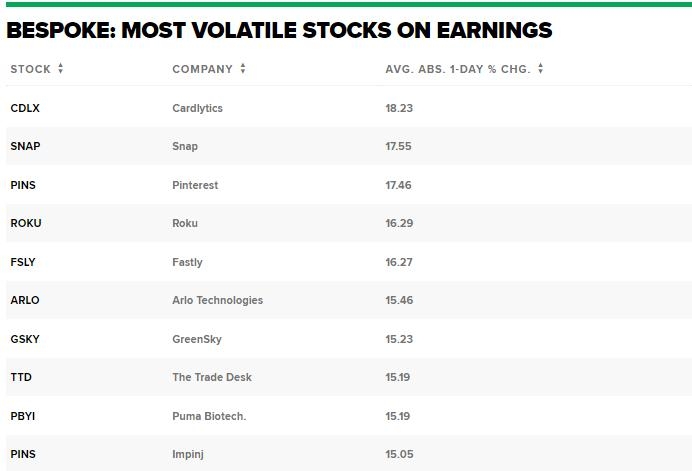

Volatility: Higher volatility in a stock can lead to larger price swings, both in favor and against the investor. Understanding the volatility of a stock is crucial before entering into options trading.

Market Sentiment: Options prices are heavily influenced by market sentiment. Keep an eye on news and trends that could impact the stock's price.

Dividends: Some stocks pay dividends, which can affect options prices. Consider this factor when selecting an optionable stock for your investment strategy.

Expiry Dates: Options have expiry dates, and they become worthless after that date. Be mindful of the expiry date when choosing your options contracts.

Conclusion

Investing in optionable US stocks can be a powerful tool for diversifying your investment portfolio and managing risk. By understanding the factors that influence stock prices and using options contracts effectively, you can capitalize on market movements and potentially achieve significant returns. Always remember to do thorough research and seek professional advice before making investment decisions.

us energy stock