The election of Donald Trump as the 45th President of the United States in 2016 marked a significant turning point in the nation's political and economic landscape. As investors and financial analysts scrambled to understand the implications of this event, the US stock market experienced a rollercoaster ride. This article delves into the aftermath of the Trump election, examining the performance of the stock market and its key drivers.

The Initial Surge

Following Trump's victory, the stock market responded positively. The S&P 500 index, a widely followed benchmark for US stocks, surged by nearly 7% in the first three months after the election. This initial surge was attributed to several factors:

- Economic Optimism: Investors were optimistic about the potential for economic growth under the Trump administration. Trump's campaign promises, including tax cuts, infrastructure spending, and deregulation, fueled expectations of a boost in economic activity.

- Corporate Earnings: Many companies reported strong earnings during the pre-election period, contributing to the market's upward momentum.

Tax Cuts and Regulatory Rollbacks

One of Trump's key campaign promises was to cut taxes. In December 2017, the Tax Cuts and Jobs Act was passed, reducing corporate tax rates from 35% to 21%. This move was widely seen as a positive catalyst for the stock market.

The S&P 500 index continued to rise, reaching record highs in 2018 and 2019. However, the market faced several challenges during this period:

- Trade Tensions: The Trump administration's aggressive stance on trade, particularly with China, created uncertainty and volatility in the market.

- Political Turmoil: The impeachment inquiry against Trump in 2019 added to the market's volatility.

The Pandemic's Impact

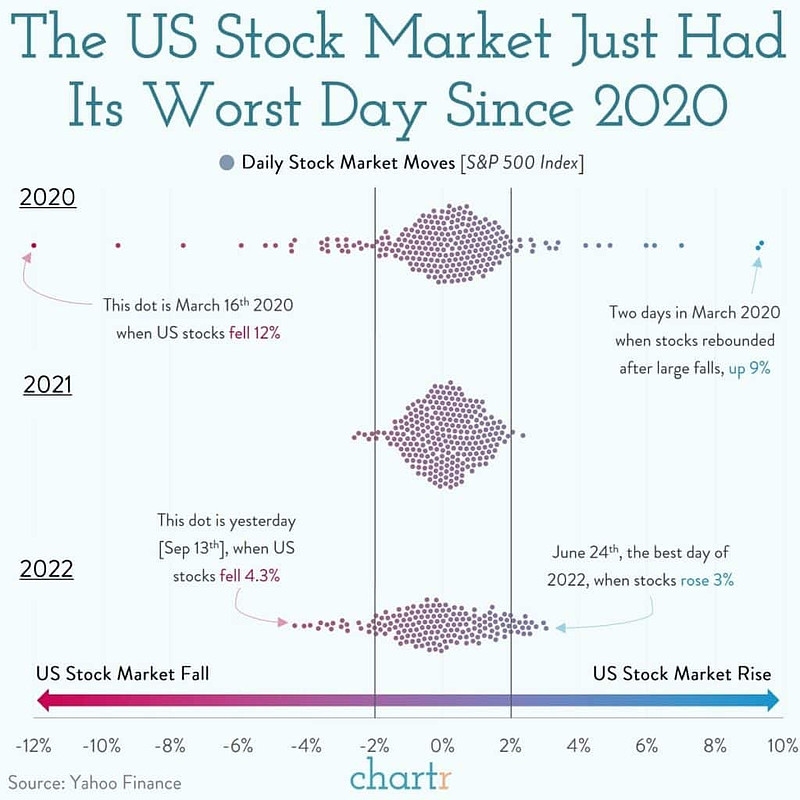

The COVID-19 pandemic in 2020 sent shockwaves through the global economy and the US stock market. The S&P 500 index plummeted by nearly 34% in March 2020, its worst-ever weekly decline. However, the market quickly recovered, with the S&P 500 closing 2020 up nearly 16%.

Key Drivers of Stock Market Performance

Several key drivers have contributed to the stock market's performance since the Trump election:

- Corporate Earnings: Strong earnings reports from companies across various sectors have supported the market's upward trend.

- Technology Stocks: The technology sector, led by giants like Apple, Amazon, and Microsoft, has been a significant driver of market performance.

- Low Interest Rates: The Federal Reserve's accommodative monetary policy, including interest rate cuts and quantitative easing, has supported the stock market by making borrowing cheaper for companies and individuals.

Case Studies

- Apple: Since the Trump election, Apple's stock has surged, nearly doubling in value. This can be attributed to the company's strong earnings reports, product innovation, and expansion into new markets.

- Tesla: Tesla, led by CEO Elon Musk, has seen its stock skyrocket since the Trump election. The company's aggressive expansion into the electric vehicle market and its success in attracting new customers have been key factors in its stock's rise.

In conclusion, the US stock market has experienced significant growth since the Trump election, driven by factors such as tax cuts, regulatory rollbacks, and strong corporate earnings. However, the market has also faced challenges, including trade tensions and the COVID-19 pandemic. As investors continue to navigate this complex landscape, understanding the key drivers of stock market performance is crucial for making informed investment decisions.

us stock market today live cha