The recent US stock fall has been a topic of concern for investors and market analysts alike. This article aims to delve into the reasons behind the downturn and provide insights into what it means for the future of the stock market.

Market Dynamics and Economic Factors

Several factors have contributed to the US stock fall. One of the primary reasons is the tightening of monetary policy by the Federal Reserve. The Fed has been increasing interest rates to combat inflation, which has led to higher borrowing costs for companies and consumers. This has, in turn, impacted the profitability of many businesses, leading to a decline in stock prices.

Another significant factor is the global economic uncertainty. The ongoing trade tensions between the US and China, along with the geopolitical tensions in Europe, have created a volatile environment for investors. This uncertainty has led to a flight to safety, with investors moving their money into assets like gold and bonds, which are considered more stable.

Sector-Specific Impacts

The US stock fall has not impacted all sectors equally. Certain sectors, such as technology and consumer discretionary, have been hit particularly hard. This is due to the fact that these sectors are highly sensitive to economic cycles and consumer spending. As the economy slows down, companies in these sectors face increased pressure on their revenue and profitability.

For example, Apple Inc., one of the largest technology companies in the world, has seen its stock price decline significantly. This is partly due to the company's reliance on consumer spending, which has been affected by the economic uncertainty.

Investor Sentiment and Market Psychology

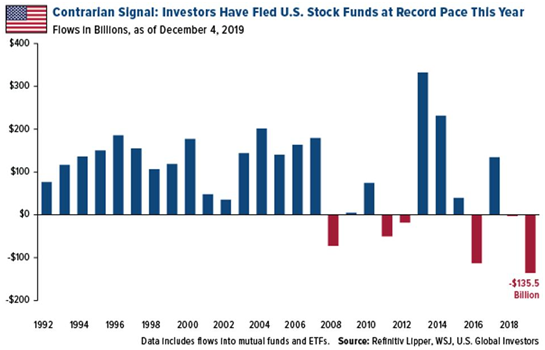

Investor sentiment plays a crucial role in the stock market. The recent US stock fall has been partly driven by negative investor sentiment. Many investors are worried about the future of the economy and are selling off their stocks to protect their investments.

However, it is important to note that market psychology can be fickle. There have been instances in the past where the stock market has experienced significant downturns, only to recover quickly. Therefore, it is essential for investors to maintain a long-term perspective and not react impulsively to short-term market movements.

Conclusion

The recent US stock fall is a complex issue with multiple contributing factors. While it is a cause for concern, it is also an opportunity for investors to re-evaluate their portfolios and make informed decisions. By understanding the underlying economic and market dynamics, investors can navigate the current market conditions more effectively.

us stock market today live cha