In recent years, there has been a significant trend among European investors to purchase US stocks. This shift in investment strategy has been fueled by various factors, including economic stability, technological advancements, and the allure of the US stock market. This article delves into the reasons behind this trend, the benefits for investors, and the potential risks involved.

Economic Stability

One of the primary reasons why Europeans are buying US stocks is the economic stability of the United States. The US economy has been consistently growing, with low unemployment rates and strong consumer spending. This stability provides investors with a sense of security, as they can expect reliable returns on their investments.

Technological Advancements

The United States is a leader in technological innovation, with numerous successful tech companies based in the country. European investors are attracted to these companies, as they represent some of the most promising growth opportunities. Companies like Apple, Google, and Facebook have become global household names, and their stocks are highly sought after by investors worldwide.

Diverse Market Opportunities

The US stock market offers a wide range of investment opportunities, from large-cap companies like Apple and Microsoft to small-cap startups with high growth potential. This diversity allows European investors to diversify their portfolios and reduce their exposure to specific sectors or regions.

Investment Returns

The US stock market has historically provided strong returns for investors. Over the past few decades, the S&P 500 index has delivered an average annual return of around 10%. This level of performance is attractive to European investors looking to grow their wealth.

Case Studies

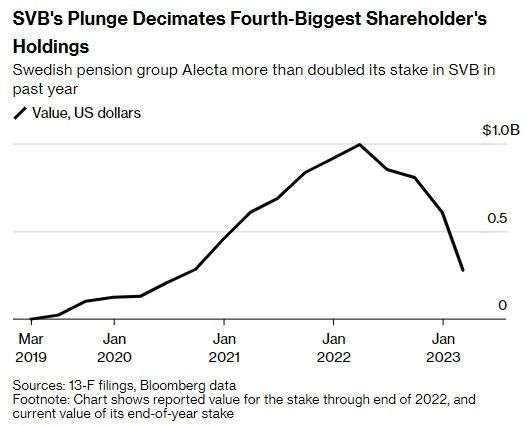

One notable case study is the purchase of US stocks by European pension funds. These funds have been actively investing in US companies to secure their future liabilities. For example, the Norwegian Government Pension Fund Global, one of the world's largest sovereign wealth funds, has allocated a significant portion of its portfolio to US stocks.

Another example is the investment by European insurance companies in US stocks. These companies are looking to diversify their portfolios and take advantage of the strong performance of the US stock market.

Benefits for Investors

Investing in US stocks can offer several benefits for European investors. These include:

- Diversification: By investing in US stocks, European investors can diversify their portfolios and reduce their exposure to specific sectors or regions.

- Growth Opportunities: The US stock market offers numerous growth opportunities, particularly in the tech and healthcare sectors.

- Strong Returns: The US stock market has historically provided strong returns for investors.

Potential Risks

While investing in US stocks offers numerous benefits, there are also potential risks to consider. These include:

- Currency Risk: Fluctuations in the exchange rate can impact the returns on investments in US stocks.

- Market Volatility: The US stock market can be volatile, leading to significant price fluctuations.

- Political Risk: Political instability in the United States can impact the performance of the stock market.

In conclusion, the trend of Europeans buying US stocks is a result of various factors, including economic stability, technological advancements, and the allure of the US stock market. While there are potential risks involved, the benefits for investors make it a compelling investment option. As the global economy continues to evolve, it is likely that this trend will persist, offering European investors new opportunities for growth and diversification.

us stock market today live cha