Navigating the US stock market can be overwhelming, especially for new investors. One of the key factors to grasp is the trading hours. Understanding when the market is open and how it operates can significantly impact your investment strategy. In this article, we'll delve into the trading hours of the US stock market, highlighting the major exchanges and providing you with essential information to make informed decisions.

The Major Exchanges and Their Trading Hours

The US stock market operates through several major exchanges, including the New York Stock Exchange (NYSE), the NASDAQ, and the American Stock Exchange (AMEX). Here's a breakdown of their trading hours:

NYSE: The NYSE operates from 9:30 AM to 4:00 PM Eastern Time (ET) from Monday to Friday. It's the oldest and largest stock exchange in the United States, listing approximately 2,800 companies.

NASDAQ: The NASDAQ is open from 9:30 AM to 12:30 PM ET for the regular trading session, followed by a 3:00 PM to 4:00 PM ET extended session for select stocks. The NASDAQ is known for its technology-focused companies and lists over 3,000 companies.

AMEX: The AMEX operates alongside the NYSE, with the same trading hours of 9:30 AM to 4:00 PM ET.

Pre-Market and After-Hours Trading

In addition to the regular trading hours, the US stock market offers pre-market and after-hours trading sessions. These sessions provide investors with additional opportunities to buy and sell stocks outside the standard trading hours.

Pre-Market Trading: This session begins at 4:00 AM ET and ends at 9:30 AM ET. It allows investors to trade stocks before the regular market opens. However, it's important to note that pre-market trading volumes are typically lower, and the prices may not reflect the full market sentiment.

After-Hours Trading: This session starts at 4:00 PM ET and continues until 8:00 PM ET. Investors can trade stocks during this time, which is particularly useful for those who cannot be online during regular trading hours. Similar to pre-market trading, after-hours trading volumes are generally lower, and prices may not accurately reflect the overall market trends.

Why It Matters

Understanding the trading hours of the US stock market is crucial for several reasons:

Investment Strategy: Knowing when the market is open allows investors to plan their trades and manage their portfolios effectively.

Price Volatility: The opening and closing of the market can cause significant price movements. Being aware of these hours can help investors avoid potential losses.

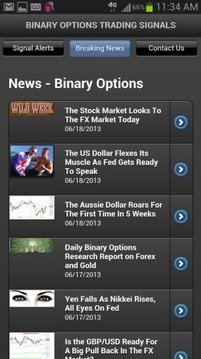

Market News: The release of economic reports, corporate earnings, and other significant news often occurs during trading hours, impacting stock prices. Staying informed about trading hours ensures you don't miss out on important updates.

Case Study: The Impact of Trading Hours on Stock Prices

Consider a hypothetical scenario where a major technology company releases its earnings report after the regular market closes. If the report is positive, the stock price may rise significantly in after-hours trading. However, if the report is negative, the stock price may plummet. Understanding the trading hours helps investors anticipate these potential price movements and make informed decisions.

In conclusion, understanding the trading hours of the US stock market is essential for successful investing. By familiarizing yourself with the major exchanges, pre-market, and after-hours trading sessions, you can navigate the market with confidence and make informed investment decisions.

us stock market today