Introduction: In 2019, investors and financial analysts were buzzing with the question: "Is the US stock market overvalued?" With record-breaking highs and concerns about economic uncertainty, it's no wonder that many were curious about the state of the market. In this article, we will delve into the factors that contribute to market valuation, analyze the data from 2019, and provide insights into whether the US stock market was indeed overvalued.

Understanding Market Valuation Market valuation is a measure of the overall worth of a stock market, typically compared to historical averages or other benchmarks. It's important to note that market valuation is not an exact science and can be influenced by various factors, including economic conditions, investor sentiment, and corporate earnings.

Key Factors Influencing Stock Market Valuation

- Economic Growth: Strong economic growth often leads to higher stock prices, as companies experience increased revenue and profitability.

- Interest Rates: Lower interest rates can make stocks more attractive, as they offer higher returns compared to fixed-income investments.

- Inflation: High inflation can erode the purchasing power of stocks, leading to lower valuations.

- Investor Sentiment: Optimistic investor sentiment can drive stock prices higher, while pessimism can lead to lower valuations.

Analyzing the 2019 US Stock Market In 2019, the US stock market experienced significant growth, with the S&P 500 index reaching record highs. However, some investors were concerned about the market's valuation, given the following factors:

- Historical Comparisons: The S&P 500's price-to-earnings (P/E) ratio was above its historical average, indicating that the market might be overvalued.

- Economic Uncertainty: Concerns about trade tensions, geopolitical risks, and slowing global economic growth added to the uncertainty surrounding the market.

- Corporate Earnings: While corporate earnings were strong in 2019, some analysts believed that the growth might not be sustainable in the long term.

Case Studies To further understand the market's valuation in 2019, let's examine a few case studies:

- Apple Inc.: Apple's stock price soared in 2019, driven by strong earnings and product launches. However, some investors were concerned about the company's valuation, as its P/E ratio was well above the market average.

- Amazon.com Inc.: Amazon's stock price also experienced significant growth in 2019, despite concerns about its valuation. The company's strong revenue growth and expansion into new markets helped to justify its high valuation.

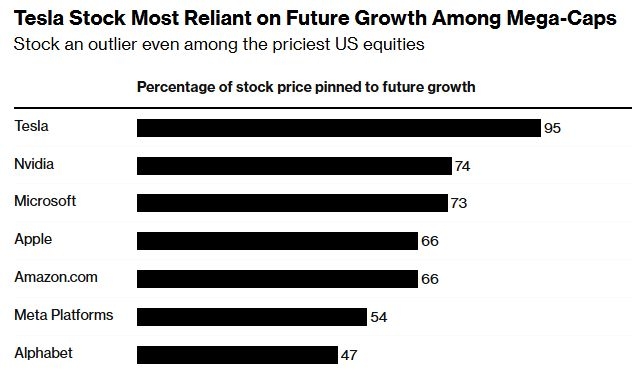

- Tesla Inc.: Tesla's stock price skyrocketed in 2019, driven by the company's ambitious growth plans and increased production of electric vehicles. However, some investors were concerned about the company's high valuation and whether it could sustain its rapid growth.

Conclusion In 2019, the US stock market faced questions about its valuation. While some investors believed that the market was overvalued, others argued that strong economic growth and corporate earnings justified the high prices. Ultimately, the market's performance in 2019 highlighted the importance of understanding the various factors that influence stock market valuation and making informed investment decisions.

us stock market today