In the vast and dynamic world of the stock market, indexes play a crucial role in providing a snapshot of the overall market performance. For U.S. stocks, there are numerous indexes that track different sectors, market capitalizations, and geographical regions. This article aims to explore the various indexes that track U.S. stocks and their significance in the financial landscape.

The S&P 500

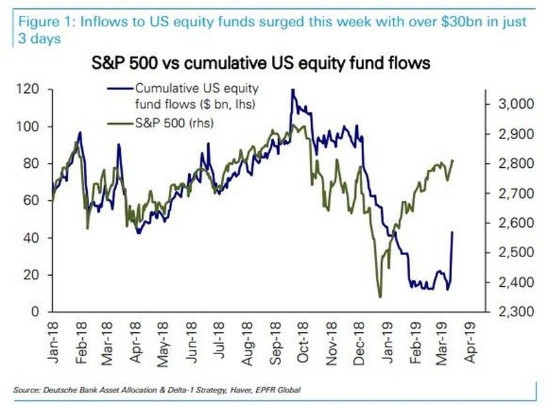

The most well-known and widely followed index is the S&P 500. It tracks the performance of 500 large-cap companies across various industries and represents approximately 80% of the total market value of all U.S. stocks. The S&P 500 is often considered a benchmark for the overall U.S. stock market and is often used as a gauge of the broader market's health.

The Dow Jones Industrial Average (DJIA)

Another iconic index is the Dow Jones Industrial Average, which consists of 30 large-cap companies from various sectors. The DJIA is one of the oldest and most recognized stock market indices, and it has been a key indicator of the U.S. stock market's performance since 1896.

The NASDAQ Composite

The NASDAQ Composite is a broad-based index that tracks the performance of all stocks listed on the NASDAQ stock exchange. It includes a mix of large, mid-cap, and small-cap companies and is known for its representation of technology companies. The NASDAQ Composite has gained significant popularity over the years, especially with the rise of tech stocks.

Sector-Specific Indexes

U.S. stocks are also tracked by sector-specific indexes that focus on specific industries. Some of the notable sector indexes include the following:

- The S&P 500 Information Technology Index: This index tracks the performance of information technology companies within the S&P 500.

- The S&P 500 Health Care Index: This index focuses on companies in the healthcare industry, including pharmaceuticals, biotechnology, and medical devices.

- The S&P 500 Energy Index: This index tracks the performance of energy companies, including oil and gas producers, refineries, and utility companies.

Geographical Indexes

Geographical indexes provide a view of the U.S. stock market from a regional perspective. Some of the notable geographical indexes include:

- The Russell 1000: This index tracks the performance of the largest 1000 companies in the U.S., representing approximately 98% of the total market value of all U.S. stocks.

- The Russell 2000: This index focuses on small-cap companies and represents approximately 2% of the total market value of all U.S. stocks.

Conclusion

In conclusion, the U.S. stock market is tracked by a diverse range of indexes, each serving a unique purpose. From the broad-based S&P 500 and DJIA to sector-specific and geographical indexes, these indices provide valuable insights into the performance of the U.S. stock market. Investors and market participants rely on these indexes to make informed decisions and stay updated on the market's movements.

us stock market today