Introduction

The stock market is a dynamic and often unpredictable entity, and many investors are left wondering if the current market downturn has reached its lowest point. The phrase "have us stocks bottomed" refers to the question of whether the stock market has hit its lowest point and is now ready to start a recovery. In this article, we will delve into various factors that could indicate whether the stock market has bottomed out and what investors should consider before making their decisions.

Historical Context

To understand whether the stock market has bottomed, it is essential to look at historical data. Over the past few decades, the stock market has experienced numerous downturns, but it has always managed to recover. For instance, the dot-com bubble burst in 2000, and the financial crisis of 2008 were both significant downturns, but the market eventually recovered. This historical context suggests that the current downturn may also be temporary.

Economic Indicators

One of the key factors to consider when determining whether the stock market has bottomed is economic indicators. These indicators can provide insights into the overall health of the economy and the potential for future growth. Some of the most important economic indicators to watch include:

- Unemployment Rate: A low unemployment rate is generally a positive sign for the economy and the stock market.

- GDP Growth: Positive GDP growth indicates that the economy is expanding, which can lead to increased corporate earnings and higher stock prices.

- Inflation: Moderate inflation is often seen as a sign of a healthy economy, but high inflation can be detrimental to stock prices.

Market Sentiment

Market sentiment is another crucial factor to consider when determining whether the stock market has bottomed. When investors are optimistic about the future, they are more likely to buy stocks, driving up prices. Conversely, when investors are pessimistic, they are more likely to sell, leading to lower prices. Some indicators of market sentiment include:

- VIX Index: The VIX, or Volatility Index, measures the market's expectation of 30-day volatility. A high VIX indicates that investors are nervous, while a low VIX suggests confidence.

- P/E Ratio: The price-to-earnings (P/E) ratio is a valuation metric that compares a company's stock price to its earnings per share. A low P/E ratio can indicate that a stock is undervalued and may be a good buying opportunity.

Sector Analysis

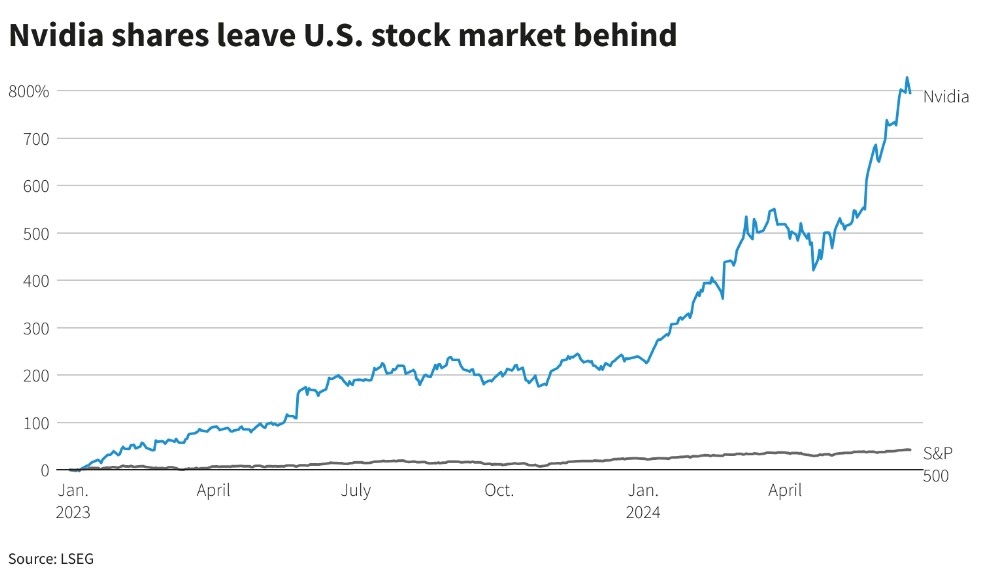

Another way to determine whether the stock market has bottomed is to analyze different sectors. Some sectors may have already bottomed out and are poised for a recovery, while others may still be falling. For example, the technology sector has been hit hard in recent years, but some companies within the sector may have already reached their lowest points and are now starting to recover.

Case Studies

To illustrate the potential for a market bottom, let's look at two case studies:

- 2008 Financial Crisis: The financial crisis of 2008 was one of the most significant downturns in recent history. However, the stock market eventually recovered, and many investors who held on through the downturn ended up making significant profits.

- 2020 COVID-19 Pandemic: The COVID-19 pandemic caused a massive shock to the global economy and the stock market. However, the market quickly recovered, and many sectors, including technology and healthcare, saw significant growth.

Conclusion

Determining whether the stock market has bottomed is a complex task that requires analyzing various factors, including economic indicators, market sentiment, and sector performance. While it is impossible to predict the future with certainty, understanding the historical context and current market conditions can help investors make informed decisions. As always, it is crucial to do thorough research and consult with a financial advisor before making any investment decisions.

us stock market today