In the interconnected world of global finance, the performance of the U.S. stock market often sets the tone for international markets. The question on many investors' minds is: do international stocks drop when U.S. stocks do? This article delves into this correlation, examining the factors at play and providing insights into how global markets are affected by U.S. market movements.

Understanding the Correlation

The correlation between U.S. and international stock markets is well-documented. When the U.S. stock market experiences a downturn, it often has a ripple effect on international markets. This is primarily due to several factors:

Global Economic Interdependence: The U.S. is the world's largest economy, and its economic health has a significant impact on global markets. When the U.S. economy slows down, it can lead to a decrease in demand for goods and services worldwide, affecting international stocks.

Currency Fluctuations: The U.S. dollar is the world's primary reserve currency, and its value often influences the value of other currencies. A weaker dollar can make U.S. stocks more attractive to foreign investors, leading to increased demand and potentially higher stock prices. Conversely, a stronger dollar can make U.S. stocks less attractive and lead to a decrease in demand.

Investor Sentiment: The U.S. stock market is often seen as a bellwether for global markets. When U.S. investors are optimistic, they tend to be more willing to invest in international markets. Conversely, when U.S. investors are pessimistic, they may pull back from international investments, leading to a decrease in demand and potentially lower stock prices.

Case Studies

Several case studies illustrate the correlation between U.S. and international stock market movements. For example:

2008 Financial Crisis: During the 2008 financial crisis, the U.S. stock market plummeted, leading to a global sell-off. International stocks followed suit, with many markets experiencing significant declines.

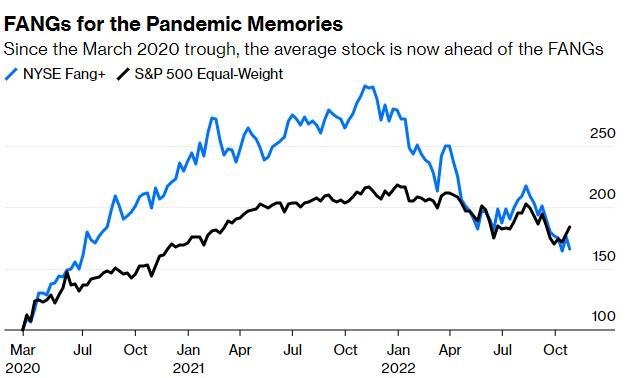

2020 COVID-19 Pandemic: The COVID-19 pandemic initially caused a sharp decline in the U.S. stock market, which in turn led to a widespread sell-off in international markets. However, as the pandemic situation improved and economic recovery efforts gained momentum, international stocks began to recover as well.

Conclusion

While there is a correlation between U.S. and international stock market movements, it's important to note that each market is influenced by its own unique set of factors. While a downturn in the U.S. stock market can have a negative impact on international stocks, it's not always a direct correlation. Investors should consider a range of factors when making investment decisions and not rely solely on the performance of the U.S. stock market.

us stock market today