Understanding the Possibility and Benefits

In the increasingly interconnected global financial market, the question of whether Canadians can trade stocks via US stock brokers has become a topic of interest. This article delves into the feasibility and advantages of this cross-border investment strategy.

Feasibility of Trading Stocks via US Brokers

Yes, Canadians can trade stocks via US stock brokers. This is made possible by the fact that many US stock brokers offer services to international clients, including Canadians. However, it's important to note that the process may differ from trading within Canada due to regulatory differences and currency exchange considerations.

Advantages of Trading Stocks via US Brokers

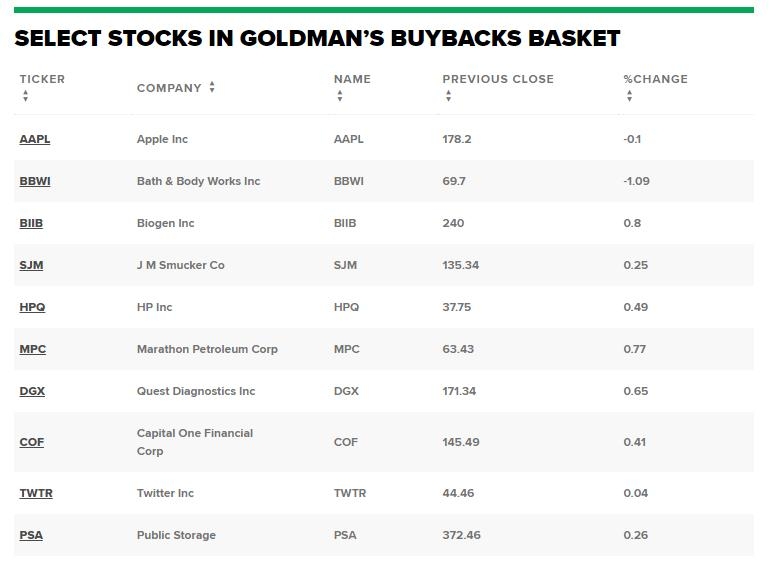

Broader Market Access: US stock brokers provide access to a wider range of stocks, including those listed on major US exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. This allows Canadian investors to diversify their portfolios and potentially benefit from a broader range of investment opportunities.

Competitive Fees: Many US stock brokers offer competitive fees compared to Canadian brokers. This can result in significant cost savings for Canadian investors, especially those trading large volumes.

Advanced Trading Platforms: US stock brokers often provide advanced trading platforms with a wide range of tools and resources to help investors make informed decisions. These platforms may offer features like real-time market data, technical analysis tools, and customizable watchlists.

Regulatory Oversight: The US Securities and Exchange Commission (SEC) oversees the activities of US stock brokers, ensuring a high level of regulatory oversight and investor protection.

Considerations for Canadian Investors

Currency Conversion: When trading stocks via US brokers, Canadian investors need to consider currency conversion fees. While many brokers offer competitive exchange rates, it's important to understand the associated costs.

Tax Implications: Canadian investors need to be aware of the tax implications of trading stocks via US brokers. While the Canadian government does not tax capital gains from foreign investments, it's important to understand the tax obligations in the US.

Regulatory Compliance: Canadian investors should ensure that the US stock broker they choose is registered with the appropriate regulatory authorities in the US and Canada.

Case Study: John's Experience

John, a Canadian investor, decided to trade stocks via a reputable US stock broker. He found that the broker offered a wide range of stocks and a user-friendly trading platform. Over time, John's portfolio grew significantly, thanks to the broader market access and competitive fees offered by the US broker.

Conclusion

In conclusion, Canadians can indeed trade stocks via US stock brokers, offering a range of benefits such as broader market access, competitive fees, and advanced trading platforms. However, it's important to consider the associated costs and tax implications before making the decision. With careful planning and due diligence, trading stocks via US brokers can be a valuable strategy for Canadian investors.

us stock market today