In the volatile world of stock trading, the term "drawdown" is often tossed around. But what exactly does it mean, and how can it impact your investment strategy? This article delves into the concept of drawdowns in the US stock market, providing you with a comprehensive guide to help you navigate through this complex terrain.

What is a Drawdown?

A drawdown in the stock market refers to a decrease in the value of an investment portfolio over a specific period. It is essentially the peak-to-trough decline in the portfolio’s value. For instance, if an investor’s portfolio was worth

Why is Understanding Drawdowns Important?

Understanding drawdowns is crucial for several reasons:

- Risk Management: By analyzing past drawdowns, investors can gain insights into the risk associated with their investments. This helps in making informed decisions and adjusting their strategy accordingly.

- Performance Evaluation: Drawdowns can be used to evaluate the performance of an investment strategy or a fund manager over time.

- Investor Sentiment: High drawdowns can lead to panic selling, while low drawdowns might indicate a well-managed portfolio.

Types of Drawdowns

There are different types of drawdowns, each with its own characteristics:

- Maximum Drawdown: This is the largest percentage decline in the value of a portfolio during a specific period.

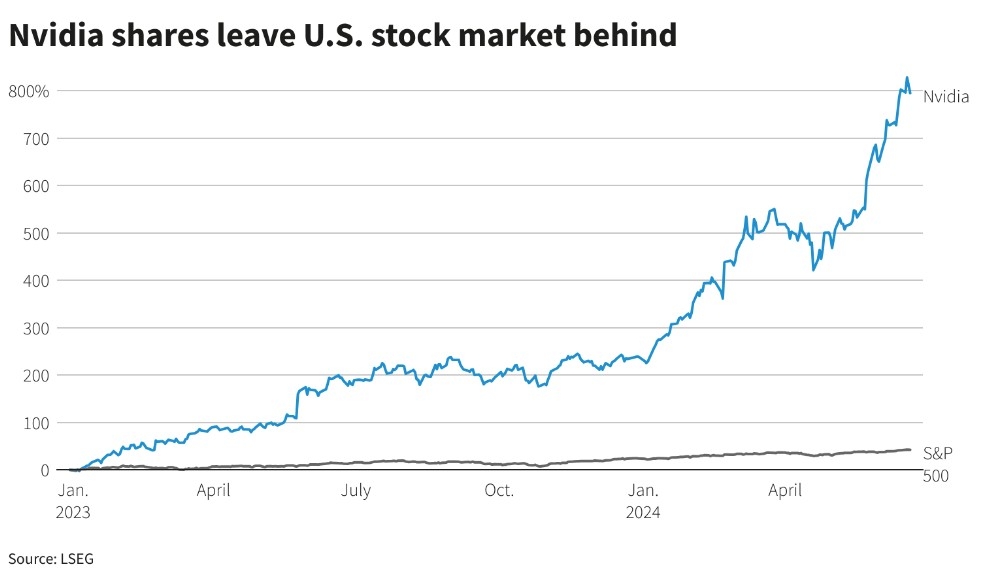

- Relative Drawdown: This measures the decline in a portfolio relative to a benchmark, such as the S&P 500.

- Stress Drawdown: This is a hypothetical drawdown that occurs under extreme market conditions, helping investors understand how their portfolio would fare in a crisis.

How to Manage Drawdowns

Here are some strategies to manage drawdowns:

- Diversification: Diversifying your portfolio across various asset classes can help reduce the impact of drawdowns.

- Risk Management: Use stop-loss orders to limit potential losses.

- Long-Term Perspective: Keep a long-term perspective and avoid panic selling during drawdowns.

- Regular Reviews: Regularly review your portfolio and make adjustments as needed.

Case Studies

Let’s take a look at a few case studies to illustrate the impact of drawdowns:

- Tech Stocks: The dot-com bubble in the late 1990s and early 2000s resulted in significant drawdowns for tech stocks. Investors who stayed invested and rode out the downturn were able to recover their losses over time.

- Real Estate: The 2008 financial crisis caused a sharp decline in real estate prices, leading to drawdowns for many investors. Those who were able to hold on through the downturn benefited from the subsequent recovery.

Conclusion

Understanding drawdowns in the US stock market is essential for investors looking to manage risk and make informed decisions. By analyzing past drawdowns and implementing effective risk management strategies, investors can navigate the volatile markets with greater confidence.

us stock market live