In the ever-fluctuating world of the stock market, a crash can send shockwaves through investors and the economy alike. Today, we're diving into the reasons behind the sudden downturn and what it means for your investments. From economic indicators to market psychology, we'll explore the factors contributing to today's stock market crash.

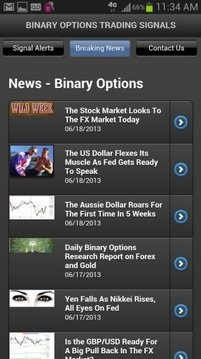

Economic Indicators and Market Trends

One of the primary reasons for today's stock market crash is the elevated inflation rates and concerns about interest rate hikes. As the Federal Reserve continues to raise interest rates to combat inflation, it creates uncertainty in the market, leading to a sell-off of stocks. Additionally, the weakening global economy and geopolitical tensions have also played a significant role in the market's downturn.

Market Psychology and Speculation

Market psychology plays a crucial role in the stock market's behavior. When investors become overly optimistic, they may overpay for stocks, leading to irrational exuberance. Conversely, when investors become overly pessimistic, they may sell off their stocks, causing a panic sell-off. Today's crash is a prime example of the latter, as investors react to the uncertainty surrounding economic indicators and market trends.

Impact on Investors

The stock market crash today has had a significant impact on investors, particularly those with exposure to risky assets. Many investors have seen their portfolios devalue significantly, leading to losses in wealth. However, it's essential to remember that the stock market is cyclical, and downturns are a natural part of the process.

Case Studies: Historical Stock Market Crashes

To understand today's stock market crash, it's helpful to look at historical examples. The 1987 stock market crash, also known as "Black Monday," saw the Dow Jones Industrial Average plummet by nearly 23% in a single day. Similarly, the 2008 financial crisis led to a significant downturn in the stock market, with the Dow Jones falling by over 50% from its peak in 2007.

While these historical crashes were driven by different factors, they serve as a reminder of the volatility and unpredictability of the stock market. Today's crash, while concerning, is not unprecedented and should be viewed in the context of the market's long-term trends.

What Investors Should Do

If you're an investor affected by today's stock market crash, it's crucial to stay level-headed and avoid panic selling. Instead, consider the following steps:

- Review Your Portfolio: Assess your investments and determine if they align with your financial goals and risk tolerance.

- Stay Informed: Keep up-to-date with economic indicators and market trends to make informed decisions.

- Diversify Your Investments: Diversification can help mitigate the impact of market downturns.

- Seek Professional Advice: Consult with a financial advisor to discuss your investment strategy and adjust as needed.

In conclusion, today's stock market crash is a reminder of the volatility and unpredictability of the market. While it's concerning for investors, it's essential to stay informed and take a long-term perspective. By understanding the factors contributing to the downturn and taking appropriate steps, investors can navigate this challenging period and emerge stronger.

us stock market live