The Dow Jones Industrial Average (DJIA), often referred to as the "blue chip index," has been a bellwether for the stock market for over a century. Tracking the performance of the 30 largest and most influential companies in the United States, the DJIA is a critical gauge of the market's health. In this article, we'll delve into the DJIA's performance over the past 12 months, highlighting key trends, significant milestones, and future prospects.

The Year in Review

Over the past year, the DJIA has experienced a rollercoaster of emotions. After starting the year on a strong note, the index faced several challenges, including geopolitical tensions, rising interest rates, and economic uncertainties. However, despite these hurdles, the DJIA managed to close the year with a solid gain.

Key Trends

Volatility: The past year has been marked by high volatility, with the DJIA experiencing sharp ups and downs. This volatility can be attributed to various factors, including global economic uncertainties and corporate earnings reports.

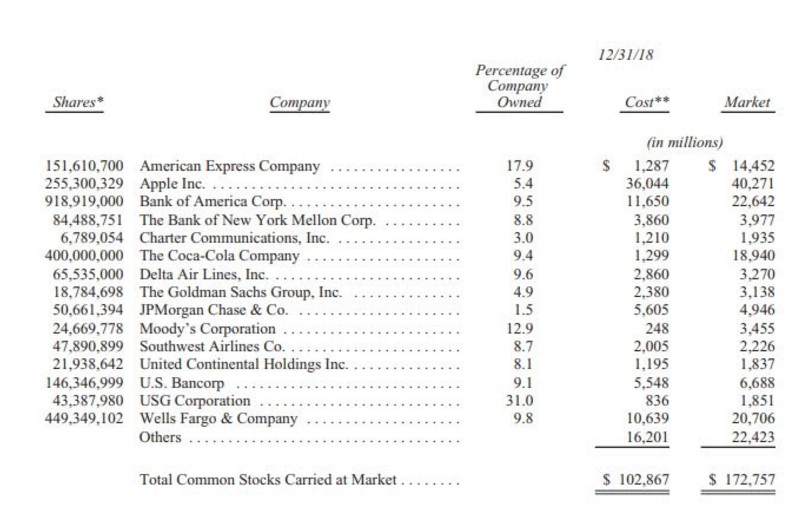

Tech Sector Outperformance: The tech sector has been a major driver of the DJIA's performance over the past year. Companies like Apple, Microsoft, and Visa have contributed significantly to the index's growth.

Recovery of Energy Sector: The energy sector, particularly oil and gas companies, has made a remarkable comeback over the past year. This recovery can be attributed to rising oil prices and increased demand for energy.

Diversification: While the tech and energy sectors have been major contributors, the DJIA has remained relatively stable due to its diversified composition. This diversification has helped mitigate the impact of market downturns.

Significant Milestones

Record Highs: The DJIA reached several record highs over the past year, demonstrating the market's resilience and strength.

Corporate Earnings: Many companies in the DJIA reported strong earnings, fueling investor confidence and contributing to the index's growth.

Dividend Increases: Many companies in the DJIA have increased their dividends, providing investors with a stable source of income.

Future Prospects

While the DJIA has performed well over the past year, the future remains uncertain. Key factors that could impact the index's performance include:

Economic Growth: The pace of economic growth in the United States and globally will play a crucial role in determining the DJIA's future performance.

Geopolitical Tensions: Continued geopolitical tensions could lead to market volatility and impact the DJIA's performance.

Interest Rates: The Federal Reserve's decision on interest rates will also be a significant factor in shaping the DJIA's future.

Case Studies

Apple: Apple's impressive performance over the past year has been a significant contributor to the DJIA's growth. The company's strong product lineup, global reach, and robust financials have made it a market leader.

ExxonMobil: The energy sector's recovery has been exemplified by ExxonMobil's performance. The company's strong earnings and increased oil production have helped drive the sector's comeback.

In conclusion, the DJIA's performance over the past 12 months has been impressive, despite the numerous challenges faced. As we look ahead, the future of the DJIA remains uncertain, but its diversification and resilience provide a strong foundation for potential growth.

us stock market live