Are you considering investing in US stocks but unsure where to start? Look no further! This comprehensive guide will walk you through everything you need to know about buying US stocks, from understanding the market to executing your investment strategy. Whether you're a beginner or an experienced investor, this article will provide you with the knowledge and confidence to make informed decisions.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid markets in the world. It consists of two primary exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list a wide range of companies, from small startups to multinational corporations.

Types of US Stocks

Before diving into the market, it's important to understand the different types of US stocks available:

- Common Stocks: These represent ownership in a company and provide voting rights. However, common stockholders are last in line when it comes to receiving dividends and assets in the event of liquidation.

- Preferred Stocks: These offer fixed dividends and priority over common stockholders in terms of receiving dividends and assets. However, preferred stockholders typically do not have voting rights.

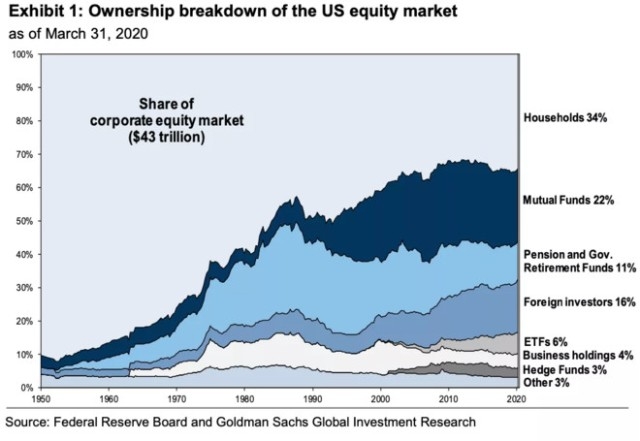

- ETFs (Exchange-Traded Funds): These are similar to mutual funds but trade on exchanges like stocks. They track a specific index or sector and offer diversification and lower fees.

How to Buy US Stocks

Buying US stocks is relatively straightforward, but there are a few steps you need to follow:

- Open a Brokerage Account: To buy stocks, you'll need a brokerage account. There are many online brokers to choose from, each with its own fees, tools, and resources. Compare brokers and choose one that fits your needs and budget.

- Fund Your Account: Once your brokerage account is set up, you'll need to fund it with cash or securities. This can be done through a bank transfer, wire transfer, or by selling existing investments.

- Research and Analyze: Before purchasing stocks, it's crucial to research and analyze potential investments. Look at financial statements, news, and other relevant information to assess the company's performance and future prospects.

- Place Your Order: Once you've chosen a stock, you can place an order through your brokerage account. You can choose to buy shares at the current market price or set a limit order to buy at a specific price.

Tips for Successful Stock Investing

To maximize your chances of success, consider the following tips:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your investments across different sectors, industries, and asset classes to reduce risk.

- Stay Informed: Keep up with the latest news and developments in the market and the companies you're invested in. This will help you make informed decisions and stay ahead of potential risks.

- Long-Term Perspective: Focus on long-term growth rather than short-term gains. The stock market can be volatile, but investing for the long term can lead to significant returns.

Case Study: Apple Inc. (AAPL)

One of the most successful companies in the US stock market is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become the world's largest company by market capitalization. By investing in Apple stock, investors have seen significant returns over the years, despite the company facing various challenges and competition.

Apple's success can be attributed to its innovative products, strong brand, and effective management. By continuously releasing new and improved products, Apple has been able to maintain its market dominance and attract loyal customers.

Conclusion

Buying US stocks can be a lucrative investment opportunity, but it requires careful research and analysis. By understanding the market, choosing the right stocks, and implementing a sound investment strategy, you can increase your chances of success. Remember to stay informed, diversify your portfolio, and maintain a long-term perspective to maximize your returns.

us stock market live