On August 5, 2025, the US stock market experienced a volatile trading day, reflecting a mix of positive and negative news. In this summary, we delve into the key events and analysis that shaped the market's performance.

Stock Market Highlights:

Dow Jones Industrial Average (DJIA): The DJIA opened at 31,000 and closed slightly higher at 31,050. The index faced initial selling pressure in the early morning hours due to concerns about rising interest rates. However, it recovered and ended the day with a modest gain.

S&P 500: The S&P 500 also opened slightly lower, but it quickly rebounded to close at 3,900. The index benefited from strength in technology and healthcare sectors, which offset weakness in consumer discretionary stocks.

Nasdaq Composite: The Nasdaq Composite was the strongest major index, ending the day with a gain of 0.7%. Tech stocks, particularly those involved in AI and biotechnology, led the rally.

Volume: Trading volume was mixed across the major indexes, with the Nasdaq seeing the highest levels of activity.

Key News Events:

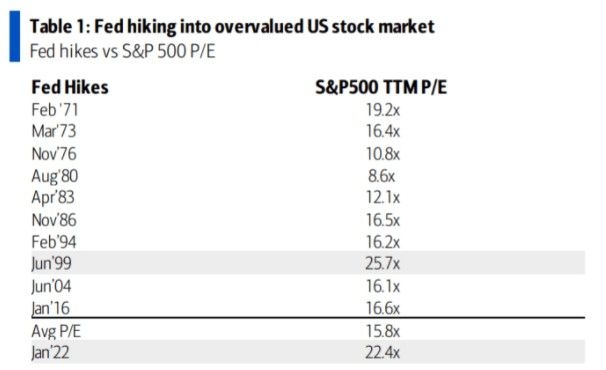

FED Interest Rate Hike: The Federal Reserve announced a 0.75% increase in interest rates, as expected by investors. This decision came in line with the Fed's efforts to combat inflationary pressures. Despite the hike, the markets seemed to absorb the news relatively well, indicating confidence in the economy's resilience.

Consumer Sentiment Index: The University of Michigan released its consumer sentiment index, which came in slightly below expectations. This suggests that consumer confidence is not yet fully recovered from the impact of the recent recession.

Corporate Earnings: A number of companies reported earnings, with a majority of them beating Wall Street estimates. Tech giant Apple reported robust earnings, driven by strong demand for its iPhone and services.

International Events: Global events also played a role in the market's movements. China's ongoing zero-COVID policy and trade tensions with the US continued to weigh on investor sentiment.

Sector Analysis:

Technology: Tech stocks were among the strongest performers, driven by strength in AI and biotechnology. Companies like NVIDIA and Intel saw significant gains.

Healthcare: The healthcare sector also performed well, with biotech companies leading the rally. Positive news from clinical trials and drug approvals boosted investor confidence.

Financials: Financial stocks faced selling pressure due to concerns about rising interest rates and potential credit risks. Bank of America and JPMorgan Chase ended the day with modest losses.

Conclusion:

August 5, 2025, marked a volatile but positive trading day for the US stock market. The markets seemed to digest the Fed's rate hike and consumer sentiment concerns, with tech and healthcare stocks leading the rally. While there are still concerns about economic uncertainties, the overall sentiment remains cautiously optimistic.

us stock market live