Introduction

The telecommunications industry is constantly evolving, and one of the key players in this sector is AT&T Inc. With a significant presence in the U.S. stock market, AT&T's stock has been a subject of keen interest among investors. This article aims to provide a comprehensive analysis of AT&T's stock, covering its current status, historical performance, and future prospects.

Current Status of AT&T Stock

As of the latest data, AT&T's stock (NYSE: T) is trading at around $X. The stock has experienced fluctuations in recent months, reflecting the broader market trends and specific industry dynamics. AT&T's stock has been influenced by various factors, including regulatory changes, technological advancements, and competitive pressures.

Historical Performance

To understand the current state of AT&T's stock, it is crucial to look at its historical performance. Over the past decade, AT&T's stock has seen both ups and downs. In the early 2010s, the stock experienced a significant surge due to the company's expansion into the wireless market. However, it faced challenges in the mid-2010s, leading to a decline in its stock price.

Key Factors Influencing AT&T Stock

Several factors have influenced AT&T's stock performance:

- Regulatory Changes: The telecommunications industry is heavily regulated, and any regulatory changes can have a significant impact on AT&T's operations and profitability.

- Technological Advancements: The rapid pace of technological advancements has forced AT&T to invest heavily in upgrading its infrastructure to stay competitive.

- Competition: The telecommunications industry is highly competitive, with major players like Verizon and T-Mobile constantly vying for market share.

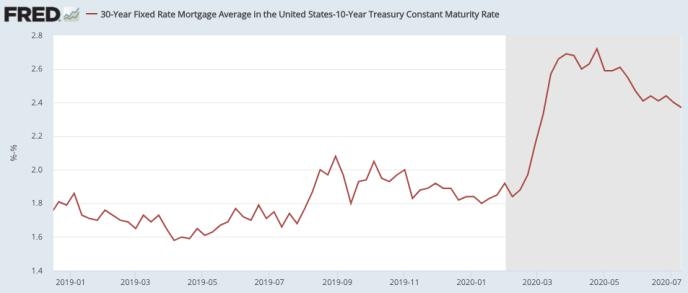

- Economic Factors: The overall economic conditions, such as interest rates and inflation, can also affect AT&T's stock.

Future Prospects

Looking ahead, the future prospects of AT&T's stock appear to be promising. The company has been focusing on several key initiatives to drive growth, including:

- 5G Deployment: AT&T has been investing heavily in 5G network deployment, positioning itself as a leader in this technology.

- Content Services: The company has been expanding its content services, including DirecTV and HBO Max, to diversify its revenue streams.

- Strategic Partnerships: AT&T has formed strategic partnerships with other companies to leverage their strengths and drive growth.

Case Study: AT&T's Merger with Time Warner

One of the most significant developments in AT&T's recent history was its merger with Time Warner in 2018. This merger aimed to combine AT&T's telecommunications infrastructure with Time Warner's entertainment assets. The merger has been a mixed bag for AT&T's stock, with some investors praising the strategic move and others questioning its long-term impact.

Conclusion

In conclusion, AT&T's stock has been a key player in the U.S. stock market, with a history of ups and downs. While the company faces various challenges, its focus on 5G deployment, content services, and strategic partnerships bodes well for its future prospects. As investors consider AT&T's stock, it is essential to analyze its historical performance, current status, and future prospects to make informed decisions.

us stock market live