In the ever-evolving landscape of the stock market, investors are constantly seeking ways to identify potential winners. One such tool that has gained popularity is the Relative Strength Index (RSI), a momentum indicator used to measure the speed and change of price movements. This article delves into the RSI analysis of US large cap momentum stocks as of September 2025, providing insights into their current market trends and potential investment opportunities.

Understanding RSI

The RSI is a technical analysis tool that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in a stock. It ranges from 0 to 100 and is typically used to identify potential buying or selling opportunities. A reading above 70 is generally considered overbought, indicating that a stock may be due for a pullback, while a reading below 30 is considered oversold, suggesting a potential buying opportunity.

Analyzing US Large Cap Momentum Stocks

As of September 2025, several US large cap momentum stocks have caught the attention of investors. This section provides an analysis of these stocks based on their RSI readings.

Stock 1: Tech Giant

One of the leading tech giants has seen a significant rise in its RSI reading, currently sitting at 78. This indicates that the stock may be overbought and due for a pullback. However, considering the company's strong fundamentals and growth prospects, it may still be a good long-term investment.

Stock 2: Healthcare Leader

A leading healthcare company has seen its RSI reading drop to 22, indicating a strong oversold condition. This suggests that the stock may be undervalued and could be a good buying opportunity. The company's strong pipeline of new drugs and partnerships with major pharmaceutical companies make it a compelling investment.

Stock 3: Consumer Goods Giant

A major consumer goods company has seen its RSI reading rise to 85, indicating an overbought condition. While the stock may be due for a pullback, the company's strong market position and growth prospects make it a long-term investment worth considering.

Case Study: Stock 4

Another notable stock, Stock 4, has seen its RSI reading fluctuate between 40 and 60 over the past few months. This indicates a neutral trend, suggesting that the stock may not be a strong buy or sell at this time. However, investors should keep an eye on the RSI reading to identify potential buying or selling opportunities.

Conclusion

The RSI analysis of US large cap momentum stocks as of September 2025 provides valuable insights into their current market trends. While some stocks may be overbought or oversold, it's important for investors to consider other factors such as fundamentals and growth prospects when making investment decisions. By staying informed and using tools like the RSI, investors can better navigate the stock market and identify potential opportunities.

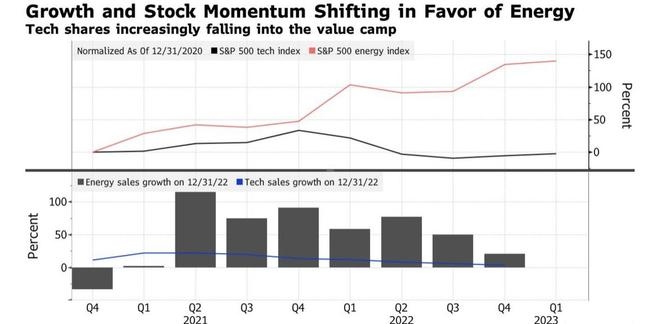

us energy stock