In the ever-evolving landscape of the stock market, identifying high-growth companies is crucial for investors looking to capitalize on market trends. The phrase "US growth stocks high momentum" encapsulates the essence of seeking out companies that are not only growing rapidly but also poised for continued expansion. This article delves into the world of high-growth stocks, offering insights into what makes them tick and how investors can identify and invest in these promising opportunities.

Understanding Growth Stocks

Growth stocks are shares of companies that are expected to grow at an above-average rate compared to their industry peers. These companies often reinvest their earnings back into the business to fuel further expansion, leading to high revenue and profit growth. Investors are attracted to growth stocks because they offer the potential for significant capital gains over the long term.

Identifying High Momentum Stocks

High momentum stocks are those that are currently experiencing rapid growth and are attracting a lot of attention from investors. These stocks often see their share prices rise quickly due to strong fundamentals and positive market sentiment. Identifying high momentum stocks requires a keen eye for market trends and a deep understanding of financial metrics.

Key Factors to Consider

When evaluating high-growth stocks, there are several key factors to consider:

- Revenue Growth: Look for companies with consistent revenue growth over several years. This indicates a strong business model and the ability to scale operations.

- Profitability: Companies with high revenue growth should also demonstrate profitability. Look for positive earnings and a growing profit margin.

- Market Position: Consider the company's market position and competitive advantage. A strong market position can lead to higher market share and pricing power.

- Management: Evaluate the quality of the company's management team. Strong leadership can make a significant difference in a company's success.

Case Study: Amazon (AMZN)

One of the most iconic examples of a high-growth stock is Amazon (AMZN). Since its inception, Amazon has grown into one of the largest and most influential companies in the world. Its revenue growth and market dominance in e-commerce have made it a prime example of a high momentum stock.

In the early 2000s, Amazon was just a start-up selling books online. However, its visionary founder, Jeff Bezos, saw the potential for the company to become a global e-commerce powerhouse. By reinvesting its earnings into expanding its product offerings and improving its logistics infrastructure, Amazon quickly grew to become the dominant player in the e-commerce space.

Today, Amazon not only operates an e-commerce platform but also offers cloud computing services through Amazon Web Services (AWS), digital streaming through Amazon Prime Video, and a range of other products and services. Its ability to diversify its business model and continue to innovate has kept it at the forefront of high-growth stocks.

Investing in High Momentum Stocks

Investing in high momentum stocks can be lucrative, but it also comes with risks. These stocks are often more volatile and can experience rapid price swings. Here are some tips for investing in high momentum stocks:

- Do Your Research: Conduct thorough research to understand the company's business model, market position, and growth prospects.

- Diversify Your Portfolio: High momentum stocks can be volatile, so it's important to diversify your portfolio to mitigate risk.

- Stay Informed: Keep up with market trends and company news to stay informed about potential risks and opportunities.

In conclusion, US growth stocks with high momentum offer exciting opportunities for investors looking to capitalize on market trends. By understanding the key factors to consider and conducting thorough research, investors can identify and invest in these promising companies. Whether you're a seasoned investor or just starting out, high-growth stocks can be a valuable addition to your investment portfolio.

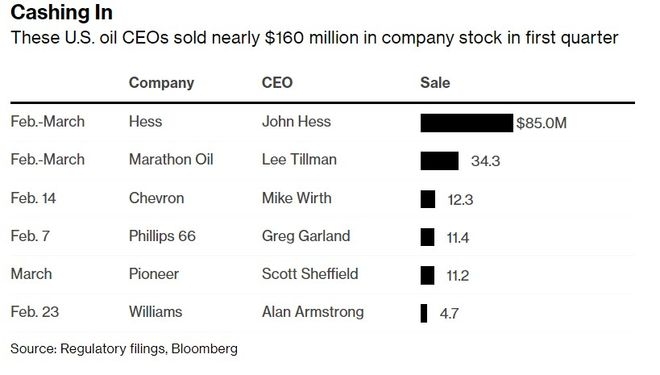

us energy stock