Are you considering investing in US dividend stocks but unsure whether to place them in an RRSP or TFSA? This article will delve into the key differences between these two popular retirement accounts, helping you make an informed decision.

Understanding RRSPs and TFSAs

An RRSP (Registered Retirement Savings Plan) and a TFSA (Tax-Free Savings Account) are both excellent ways to save for retirement. However, they differ significantly in terms of tax implications and contribution limits.

RRSPs: Tax-Deferred Growth

An RRSP allows you to contribute pre-tax dollars, which means your contributions reduce your taxable income in the year you make them. The money grows tax-deferred, meaning you won't pay taxes on the gains until you withdraw the funds in retirement. This can be particularly beneficial if you expect to be in a lower tax bracket during retirement.

TFSAs: Tax-Free Growth

In contrast, a TFSA allows you to contribute after-tax dollars, and the money grows tax-free. This means you won't pay taxes on the gains or the withdrawals in retirement. TFSAs are an excellent option if you're looking for a flexible savings vehicle that won't impact your retirement income.

US Dividend Stocks in RRSPs

Investing in US dividend stocks within an RRSP can be a smart move. Here's why:

- Tax-Deferred Growth: As mentioned earlier, the tax-deferred growth of an RRSP can be advantageous if you expect to be in a lower tax bracket in retirement.

- Diversification: Investing in US dividend stocks can provide diversification to your portfolio, as the US market often performs differently from the Canadian market.

- Potential for High Returns: Many US dividend stocks have a long history of stable and growing dividends, making them an attractive investment for long-term growth.

US Dividend Stocks in TFSAs

Investing in US dividend stocks within a TFSA also has its benefits:

- Tax-Free Growth: The tax-free nature of a TFSA means you won't pay taxes on the gains or withdrawals, providing more flexibility in your retirement planning.

- No Impact on RRSP Contributions: Since TFSAs are separate from RRSPs, you can contribute to both accounts without affecting your RRSP contribution room.

- Potential for Tax-Free Withdrawals: If you've already maxed out your RRSP contributions, a TFSA can be a great way to save for retirement without impacting your tax situation.

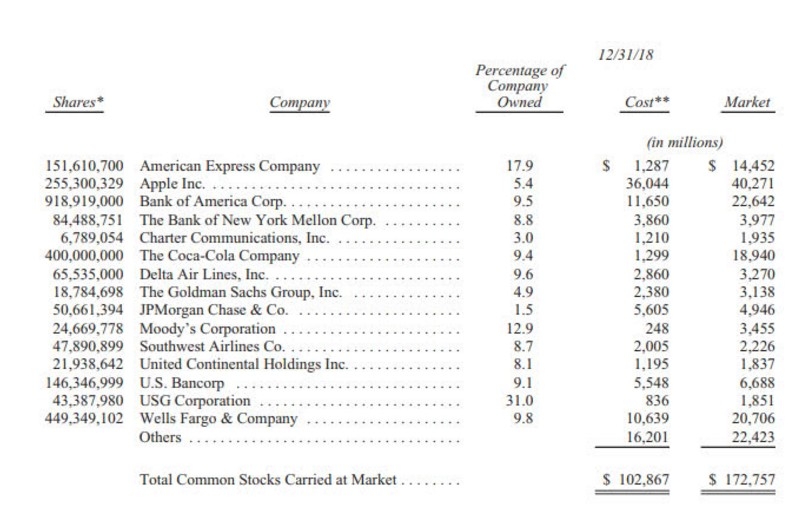

Case Study: Apple Inc.

Let's consider Apple Inc. (AAPL) as an example. Apple is a well-known US dividend stock with a long history of stable and growing dividends. If you invest in Apple within an RRSP, the dividends will be taxed at your marginal tax rate when you withdraw them in retirement. However, if you invest in Apple within a TFSA, the dividends will be tax-free, providing more flexibility in your retirement planning.

Conclusion

Investing in US dividend stocks within an RRSP or TFSA depends on your individual circumstances and retirement goals. Both accounts offer unique benefits, and it's essential to consider your tax situation, risk tolerance, and investment strategy when making your decision.

us energy stock