In the rapidly evolving landscape of the stock market, the term "net net stocks" has gained significant attention. These undervalued companies present an intriguing investment opportunity for those who are willing to do their homework. As we approach 2025, understanding the potential of net net stocks is crucial for any investor looking to capitalize on market inefficiencies.

What are Net Net Stocks?

Net Net Stocks are companies trading at a significant discount to their net current asset value (NCAV). NCAV is a valuation metric that represents the total value of a company's assets minus its total liabilities. When a company's market capitalization is less than its NCAV, it is considered a net net stock.

The rationale behind investing in net net stocks lies in the fact that these companies are often undervalued due to market inefficiencies, mismanagement, or temporary setbacks. This undervaluation presents a unique opportunity for investors to acquire substantial assets at a low price.

The Attractiveness of Net Net Stocks in 2025

As we look ahead to 2025, several factors make net net stocks an attractive investment opportunity:

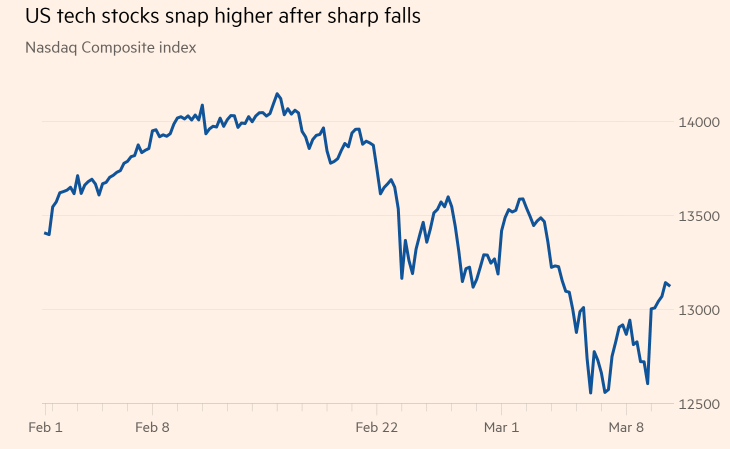

Market Volatility: In times of market volatility, companies that are trading at a discount to their NCAV are likely to be overlooked by the broader market. This can create a window of opportunity for investors to buy these stocks at a bargain.

Recovery Potential: Many net net stocks have the potential for a turnaround. By identifying these companies and holding onto them for the long term, investors can benefit from a significant increase in their stock price as the market recognizes their true value.

High Dividend Yields: Many net net stocks are profitable companies that generate substantial cash flows. These companies often distribute a significant portion of their earnings to shareholders through dividends, providing investors with a steady income stream.

Case Study: Berkshire Hathaway's Investment in Net Net Stocks

A prime example of successful investing in net net stocks is Berkshire Hathaway, the renowned investment company founded by Warren Buffett. Buffett has a history of investing in companies that are trading at a discount to their NCAV, such as See's Candies and General Re.

In 2010, Buffett purchased 63.9 million shares of IBM at an average price of

Since then, IBM's stock price has more than doubled, demonstrating the potential of investing in net net stocks.

Investing in Net Net Stocks: A Strategic Approach

Investing in net net stocks requires a strategic approach:

Research: Conduct thorough research to identify companies that are trading at a significant discount to their NCAV. Look for companies with a strong balance sheet, solid fundamentals, and a history of profitability.

Patience: Investing in net net stocks requires patience. It may take time for the market to recognize the true value of these companies. Investors should be prepared to hold onto their investments for the long term.

Risk Management: While net net stocks offer potential for significant returns, they also come with risks. It is important to diversify your portfolio and manage your risk appropriately.

Conclusion

As we approach 2025, net net stocks present a lucrative investment opportunity for those who are willing to take a strategic approach. By understanding the potential of these undervalued companies and conducting thorough research, investors can capitalize on market inefficiencies and achieve significant returns.

us energy stock