Are you considering adding U.S. Steel to your investment portfolio? If so, you're not alone. As the world's largest steel producer by volume, U.S. Steel has long been a topic of interest for investors. But is its stock worth buying? Let's delve into the details to help you make an informed decision.

Understanding U.S. Steel's Background

Established in 1901, U.S. Steel has a storied history of innovation and leadership in the steel industry. The company has played a pivotal role in shaping the infrastructure of the United States, from the construction of the first skyscrapers to the production of steel for the World War II effort. Today, U.S. Steel operates in various segments, including flat-rolled steel, tubular products, and special steel.

Analyzing U.S. Steel's Financial Health

One of the most critical factors to consider when evaluating a stock is its financial health. Here's a breakdown of U.S. Steel's financials:

- Revenue: U.S. Steel has seen fluctuations in revenue over the years, primarily due to the cyclical nature of the steel industry. However, the company has shown consistent growth in recent quarters.

- Profitability: U.S. Steel has struggled with profitability in the past, but the company has made significant strides in improving its margins. This includes reducing costs and enhancing operational efficiency.

- Debt: U.S. Steel has a substantial amount of debt, which can be a concern for some investors. However, the company has a solid credit rating and has been able to manage its debt load effectively.

Examining the Steel Industry Outlook

To determine whether U.S. Steel's stock is worth buying, it's essential to consider the outlook for the steel industry:

- Demand: The global demand for steel has been increasing, driven by infrastructure projects, automotive production, and manufacturing. This demand is expected to continue growing in the coming years.

- Competition: The steel industry is highly competitive, with numerous players vying for market share. However, U.S. Steel's strong brand and extensive customer base give it a competitive advantage.

- Regulations: The steel industry is subject to various regulations, which can impact pricing and production. U.S. Steel has been proactive in addressing these regulations and maintaining compliance.

U.S. Steel's Competitive Advantage

U.S. Steel has several competitive advantages that set it apart from its competitors:

- Technology: The company has invested heavily in advanced steelmaking technologies, which have improved its efficiency and product quality.

- Global Presence: U.S. Steel operates in various countries, providing a diversified customer base and reducing exposure to regional economic fluctuations.

- Innovation: The company is committed to research and development, continuously improving its products and processes.

Case Studies: U.S. Steel's Success Stories

Several case studies highlight U.S. Steel's success:

- The Ohio Valley Works: This facility has been a significant driver of U.S. Steel's growth, producing high-quality steel for various applications.

- The Minntac Mine: U.S. Steel's acquisition of the Minntac mine has provided a stable supply of iron ore, further enhancing the company's cost competitiveness.

Conclusion

In conclusion, U.S. Steel's stock presents a compelling opportunity for investors. The company's solid financial health, competitive advantages, and positive outlook for the steel industry make it a strong candidate for your portfolio. However, as with any investment, it's crucial to conduct thorough research and consider your own risk tolerance before making a decision.

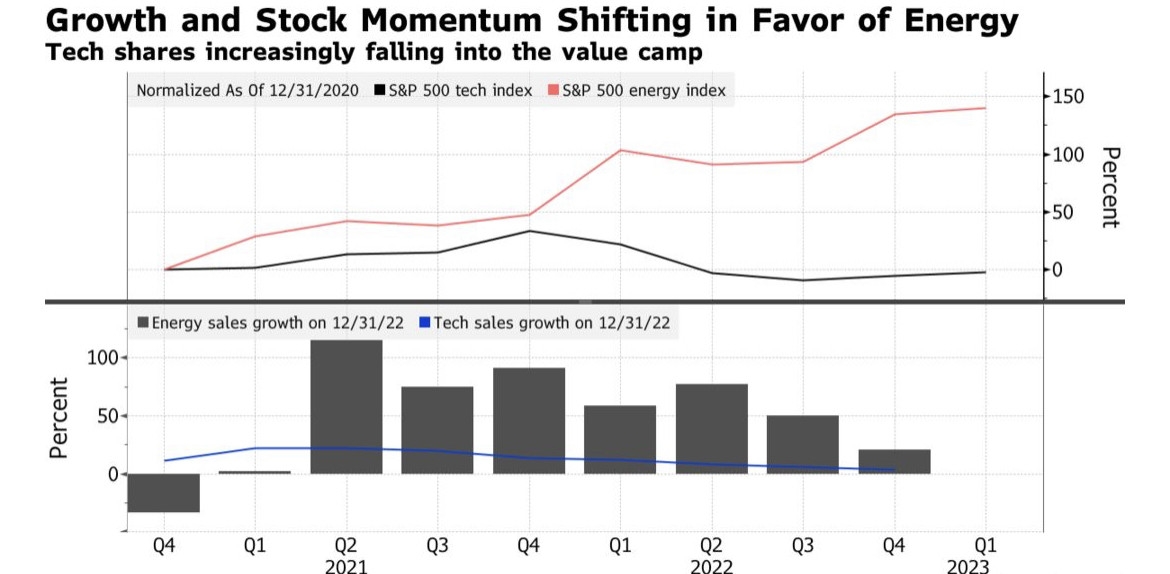

us energy stock