Are you an investor looking to expand your portfolio into the US OTC (Over-The-Counter) market while located in the UK? Investing in US OTC stocks can be a lucrative venture, but it requires understanding the process and the risks involved. This guide will walk you through the steps to buy US OTC stocks in the UK, ensuring a smooth and informed investment journey.

Understanding US OTC Stocks

Before diving into the process, it's essential to understand what US OTC stocks are. Unlike stocks listed on major exchanges like the NYSE or NASDAQ, OTC stocks are traded outside these exchanges. These stocks are often from smaller companies that may not meet the strict listing requirements of larger exchanges. Despite their smaller size, OTC stocks can offer significant growth potential.

Steps to Buy US OTC Stocks in the UK

1. Open a Brokerage Account

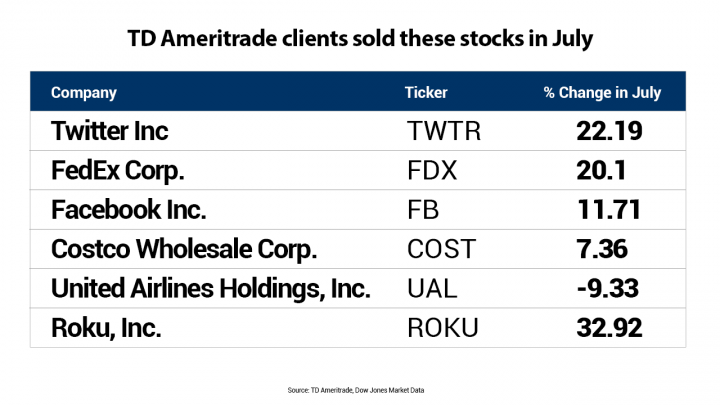

The first step is to open a brokerage account. In the UK, you have numerous brokerage firms that offer access to the US OTC market. When choosing a brokerage, consider factors such as fees, customer service, and available trading platforms. Popular brokers include Interactive Brokers, TD Ameritrade, and Charles Schwab.

Important Note: Ensure your chosen brokerage allows you to trade OTC stocks and offers the necessary tools for analysis and monitoring.

2. Understand the Risks

Investing in OTC stocks carries higher risks compared to listed stocks. These risks include liquidity issues, limited information availability, and potential market manipulation. Before investing, conduct thorough research on the company, its business model, and financials.

3. Fund Your Account

Once your brokerage account is set up, you'll need to fund it. You can transfer funds from your UK bank account or use an international wire transfer. Some brokers also offer credit card funding, but this option should be used cautiously due to potential fees and risks.

4. Find US OTC Stocks

To find US OTC stocks, you can use various online platforms. Websites like OTC Markets Group provide a comprehensive list of OTC stocks, including their trading symbols and market prices. You can search for specific companies or industries to narrow down your options.

5. Place Your Order

Once you've identified a US OTC stock you're interested in, you can place your order through your brokerage platform. Ensure you understand the order type (market or limit order) and set a stop-loss to protect your investment.

6. Monitor Your Investment

After purchasing your US OTC stocks, it's crucial to monitor them regularly. Stay informed about market trends, company news, and regulatory updates that may impact the stock's performance.

Case Study: Investing in OTC Stocks

Consider a scenario where you've identified a promising OTC stock from the healthcare sector. By conducting thorough research, you determine that the company has a strong product pipeline and a solid management team. After analyzing the market trends and placing a well-thought-out order, your investment grows significantly within a few months.

Conclusion

Investing in US OTC stocks from the UK requires careful planning and research. By following the steps outlined in this guide, you can successfully navigate the process and potentially reap substantial returns. Always remember to understand the risks involved and monitor your investments closely.

us energy stock