Are you an Indian investor looking to diversify your portfolio? Have you ever wondered if you can invest in US stocks? The answer is a resounding yes! Investing in US stocks from India is not only possible but also offers numerous benefits. In this comprehensive guide, we will explore the process, the advantages, and the risks associated with investing in US stocks as an Indian investor.

Understanding the Basics

What are US Stocks? US stocks are shares of ownership in a company that is listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. When you buy a US stock, you become a partial owner of that company, and your investment is subject to the company's performance.

Why Invest in US Stocks? Investing in US stocks offers several advantages:

- Diversification: The US stock market is one of the largest and most diversified in the world. Investing in US stocks allows you to gain exposure to a wide range of industries and sectors.

- Strong Economic Growth: The US economy has a strong track record of growth, making it an attractive destination for investors.

- High Liquidity: US stocks are highly liquid, meaning you can buy and sell them easily.

- Potential for High Returns: Historically, US stocks have provided higher returns than many other investments.

How Can an Indian Invest in US Stocks?

There are several ways for Indian investors to invest in US stocks:

- Through a Brokerage Account: You can open a brokerage account with a US-based brokerage firm and purchase US stocks directly.

- Through a Mutual Fund: Many mutual funds offer exposure to US stocks. You can invest in these funds through a local broker or through an online platform.

- Through a ETF: Exchange-traded funds (ETFs) are a type of investment fund that tracks a specific index, such as the S&P 500. You can buy and sell ETFs like stocks.

- Through a Robo-advisor: Robo-advisors are automated investment platforms that provide personalized investment advice and manage your portfolio. Some robo-advisors offer US stock investments.

Important Considerations

Before investing in US stocks, there are several important considerations to keep in mind:

- Currency Conversion: When you invest in US stocks, your returns will be converted back to Indian rupees. This can impact your overall returns.

- Tax Implications: Indian investors need to be aware of the tax implications of investing in US stocks. You may need to pay taxes on your investment gains.

- Regulatory Requirements: Indian investors need to comply with regulatory requirements when investing in US stocks.

Case Study: Investing in Apple Inc.

Let's consider an example of investing in Apple Inc., one of the most popular US stocks. Suppose you decide to invest

Conclusion

Investing in US stocks from India is a viable option for Indian investors looking to diversify their portfolios. By understanding the basics, considering the advantages and risks, and following the necessary steps, you can successfully invest in US stocks and potentially benefit from high returns.

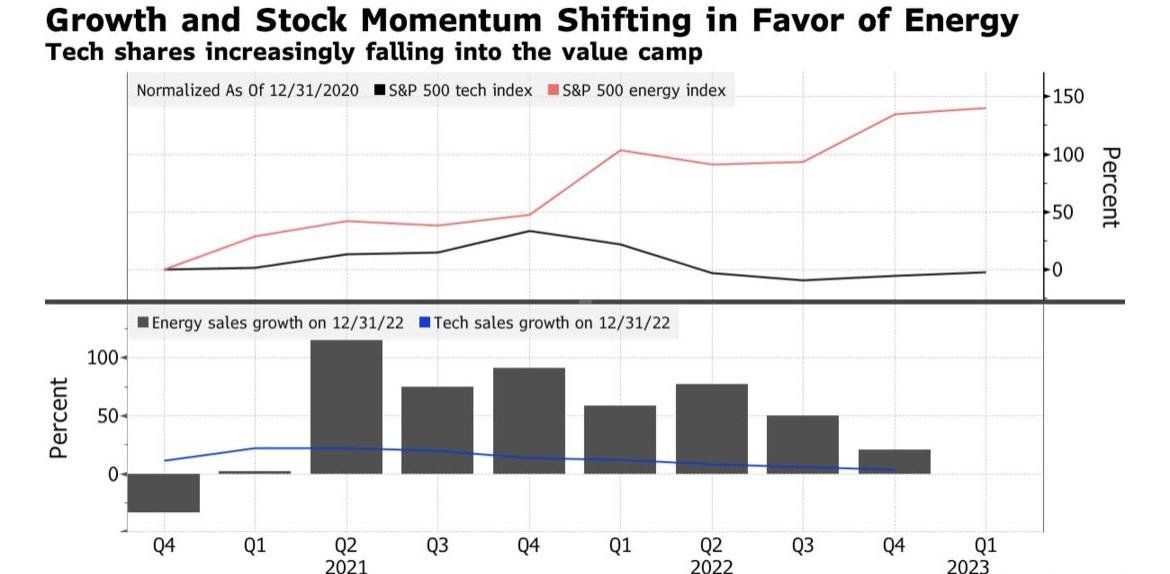

us energy stock