In today's interconnected world, the ability to trade stocks from anywhere in the world has become more accessible than ever. If you're planning a trip overseas and want to stay on top of your investment portfolio, you might be wondering: "Can you trade U.S. stock while overseas?" The answer is a resounding yes, and in this article, we'll explore the ins and outs of trading U.S. stocks from abroad.

Understanding the Basics

Before diving into the specifics of trading U.S. stocks while overseas, it's important to understand the basics. Trading stocks involves buying and selling shares of a company, with the goal of making a profit. When you trade U.S. stocks, you're buying and selling shares of companies listed on American stock exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq.

Requirements for Trading U.S. Stocks Overseas

To trade U.S. stocks while overseas, you'll need to meet a few requirements:

A Brokerage Account: The first step is to open a brokerage account with a U.S.-based brokerage firm. This account will allow you to buy and sell stocks and other securities.

An International Bank Account: You'll also need an international bank account to deposit and withdraw funds for your investments.

Understanding the Risks: It's important to understand the risks involved in trading stocks, especially when you're overseas. Currency fluctuations, time zone differences, and regulatory differences can all impact your investment decisions.

Steps to Trade U.S. Stocks While Overseas

Once you have the necessary requirements in place, here's how to get started:

Research and Choose a Brokerage Firm: Research different brokerage firms and choose one that meets your needs. Look for a firm with a good reputation, low fees, and reliable customer service.

Open a Brokerage Account: Follow the brokerage firm's instructions to open an account. You'll need to provide personal information, including your name, address, and social security number.

Fund Your Account: Transfer funds from your international bank account to your brokerage account. You can do this via wire transfer or other methods offered by the brokerage firm.

Research and Analyze Stocks: Research the stocks you're interested in and analyze their performance. Use financial websites, news outlets, and other resources to stay informed.

Place Trades: Once you've identified the stocks you want to buy, place your trades through your brokerage account. You can do this online or by contacting your broker.

Tips for Successful Trading

Here are a few tips to help you succeed in trading U.S. stocks while overseas:

Stay Informed: Keep up with financial news and market trends to make informed investment decisions.

Use Stop-Loss Orders: To minimize potential losses, use stop-loss orders to automatically sell a stock if it falls below a certain price.

Diversify Your Portfolio: Diversify your investments to reduce risk and increase potential returns.

Understand Currency Fluctuations: Be aware of how currency fluctuations can impact your investments and adjust your strategy accordingly.

Case Study: Trading U.S. Stocks from Abroad

Let's consider a hypothetical scenario. John, a software engineer living in Germany, wants to invest in U.S. tech stocks. He opens a brokerage account with a U.S.-based firm, funds his account, and starts researching tech companies. After analyzing various companies, he decides to invest in Apple and Microsoft. He sets up stop-loss orders and monitors his investments regularly. Over time, his investments grow, and he achieves a good return on his investment.

Conclusion

Trading U.S. stocks while overseas is possible and can be a lucrative investment strategy. By understanding the requirements, following the steps, and staying informed, you can successfully trade U.S. stocks from anywhere in the world.

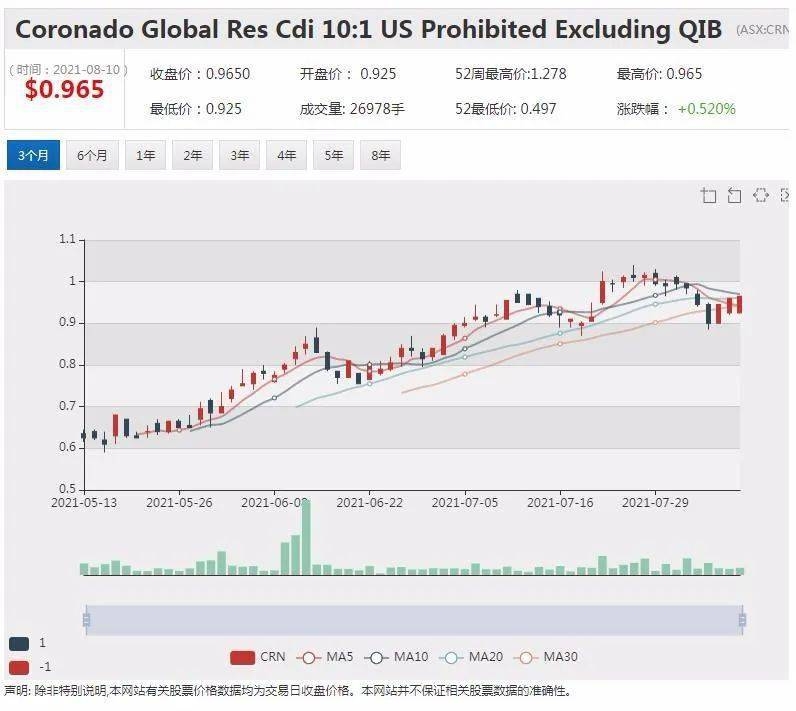

us energy stock