In the globalized world of finance, the question of whether other countries can buy U.S. stocks is not only intriguing but also significant for investors and policymakers alike. The U.S. stock market, often referred to as the world's largest and most influential, has always been a major destination for international investors. This article delves into the intricacies of this question, exploring the various aspects that come into play when it comes to cross-border investments in U.S. stocks.

Understanding the U.S. Stock Market

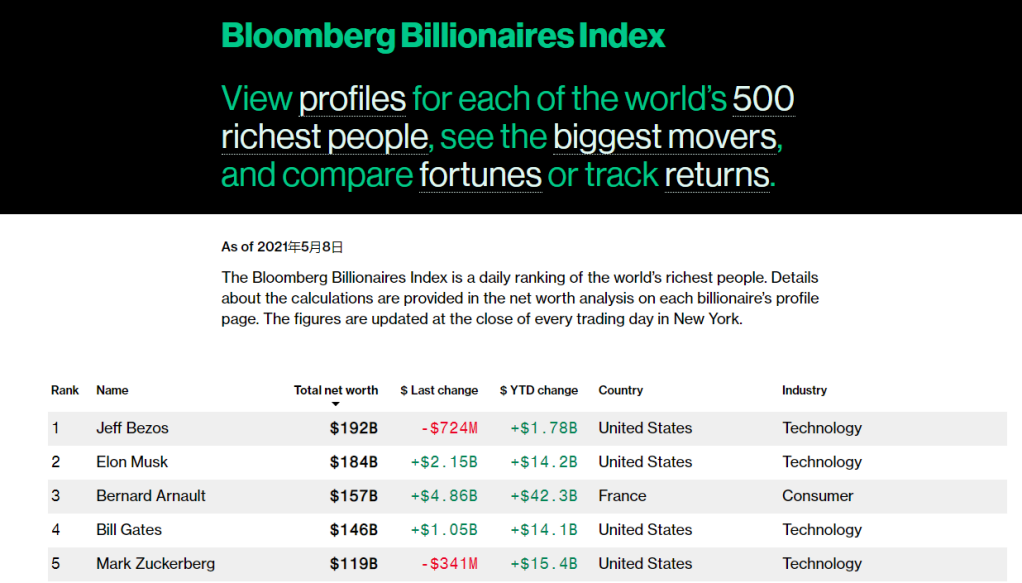

The U.S. stock market, primarily represented by the New York Stock Exchange (NYSE) and the NASDAQ, is home to some of the most recognized and successful companies in the world. From tech giants like Apple and Microsoft to traditional industries such as energy and finance, the U.S. market offers a diverse range of investment opportunities.

International Investors and U.S. Stocks

Can other countries buy U.S. stocks? The answer is a resounding yes. International investors have been actively participating in the U.S. stock market for decades. This participation is facilitated through various means, including:

- Direct Investment: International investors can purchase U.S. stocks directly from the exchanges, provided they have the necessary legal and regulatory compliance in place.

- Through Mutual Funds and ETFs: Many mutual funds and exchange-traded funds (ETFs) are designed to track the performance of the U.S. stock market. International investors can invest in these funds, thereby indirectly owning U.S. stocks.

- Brokerage Accounts: International investors can open brokerage accounts with U.S. brokerage firms, allowing them to buy and sell U.S. stocks directly.

Legal and Regulatory Considerations

While international investors can buy U.S. stocks, there are certain legal and regulatory considerations to keep in mind:

- Tax Implications: International investors must comply with U.S. tax laws, including reporting requirements and potential tax liabilities.

- Regulatory Compliance: Certain countries may have specific regulations governing investments in foreign stocks, which international investors must adhere to.

- Currency Exchange: International investors may need to consider currency exchange rates when purchasing U.S. stocks.

Case Study: China’s Investment in U.S. Stocks

One notable example of international investment in the U.S. stock market is China. Over the years, China has been a significant investor in U.S. stocks, particularly in the tech sector. This investment has been facilitated through various channels, including direct purchases and investments in mutual funds and ETFs.

Conclusion

In conclusion, the answer to the question, “Can other countries buy U.S. stocks?” is a resounding yes. International investors have been actively participating in the U.S. stock market for years, driving growth and innovation. However, it is crucial for international investors to understand the legal and regulatory landscape before making investments in U.S. stocks.

us energy stock