In today's fast-paced financial world, investing in US stocks has become a popular choice for both seasoned investors and newcomers alike. With a diverse range of companies and industries, the US stock market offers a wealth of opportunities for growth and profit. This article aims to provide a comprehensive guide to understanding and investing in US stocks, covering key aspects such as market trends, investment strategies, and potential risks.

Understanding the US Stock Market

The US stock market is one of the largest and most influential in the world, with a history that dates back to the early 18th century. It is home to some of the world's most successful and well-known companies, including Apple, Google, and Microsoft. The market is divided into two primary exchanges: the New York Stock Exchange (NYSE) and the NASDAQ.

Market Trends

When considering investing in US stocks, it's crucial to stay informed about the latest market trends. Historically, the US stock market has shown strong growth over the long term, with periods of both ups and downs. Understanding these trends can help investors make informed decisions and capitalize on opportunities.

One key trend to watch is the rise of technology stocks. As technology continues to advance, companies in this sector are expected to see significant growth. Additionally, the increasing popularity of renewable energy and electric vehicles has led to a surge in investment in these industries.

Investment Strategies

There are several investment strategies to consider when investing in US stocks:

- Dividend Stocks: These are stocks that pay out a portion of their earnings to shareholders. They can be a stable source of income and are often favored by income investors.

- Growth Stocks: These stocks are of companies with high growth potential. They may not pay dividends, but their share prices can increase significantly over time.

- Value Stocks: These are stocks that are trading at a lower price than their intrinsic value. Value investors look for these opportunities to buy undervalued stocks and sell them at a higher price in the future.

Risks and Considerations

While investing in US stocks can be lucrative, it's important to be aware of the risks involved:

- Market Volatility: The stock market can be unpredictable, with prices fluctuating rapidly. This can lead to significant gains or losses.

- Economic Factors: Economic conditions, such as inflation or a recession, can impact the stock market and individual stocks.

- Company-Specific Risks: The performance of a stock is influenced by the company's own financial health and business decisions.

Case Studies

To illustrate the potential of US stocks, let's look at a few case studies:

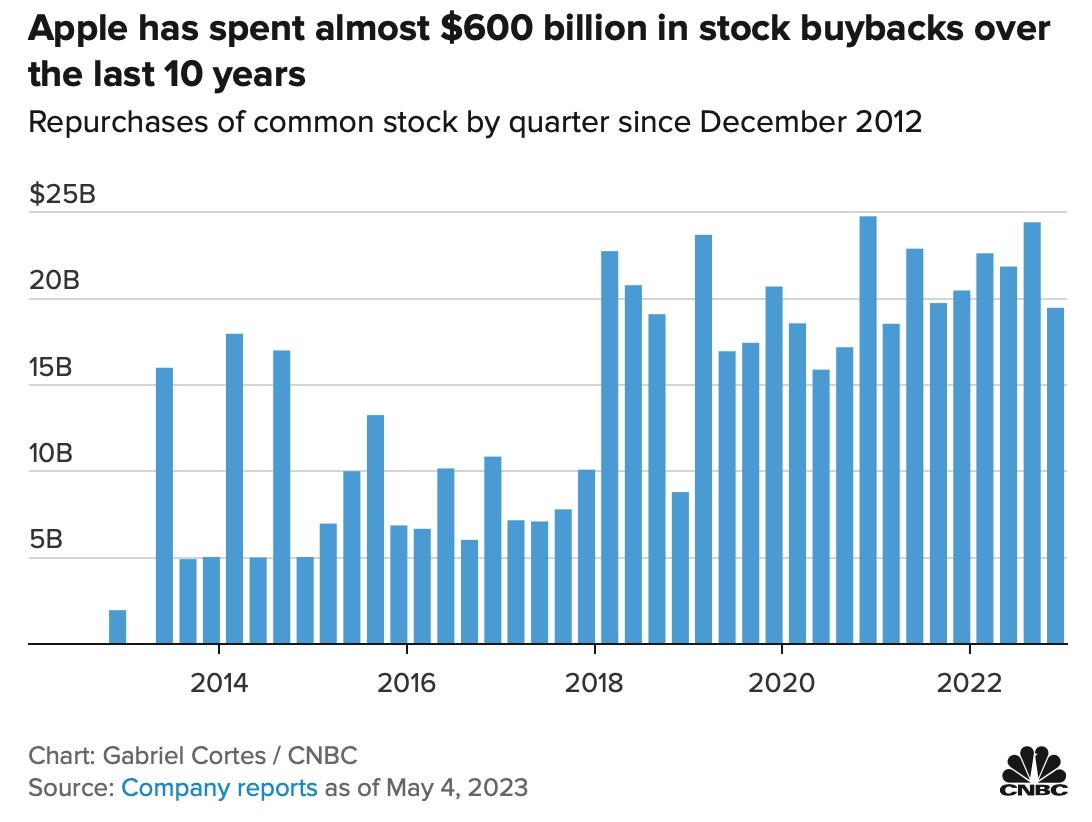

- Apple Inc. (AAPL): Since its initial public offering (IPO) in 1980, Apple has become one of the most valuable companies in the world. Its innovative products and strong brand have driven significant growth in its stock price.

- Tesla Inc. (TSLA): As the leader in electric vehicles, Tesla has seen rapid growth in its stock price, driven by its commitment to innovation and sustainability.

Conclusion

Investing in US stocks can be a rewarding endeavor, but it requires careful research and consideration of market trends, investment strategies, and risks. By staying informed and adopting a disciplined approach, investors can unlock the potential of US stocks and achieve their financial goals.

new york stock exchange