Are you a foreign investor looking to diversify your portfolio and explore the lucrative US stock market? Investing in US stocks can be a game-changer for your financial future. In this article, we will delve into the essential steps and strategies for foreign investors to successfully invest in US stocks.

Understanding the US Stock Market

The US stock market is one of the largest and most dynamic in the world, with numerous opportunities for foreign investors. The major stock exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a wide range of stocks from various industries, making it easier for foreign investors to find suitable investments.

Opening a Brokerage Account

To invest in US stocks, you need to open a brokerage account. A brokerage account allows you to buy and sell stocks, bonds, and other securities. When choosing a brokerage firm, consider factors such as fees, customer service, and available investment options. Some popular brokerage firms for foreign investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Understanding the Risks

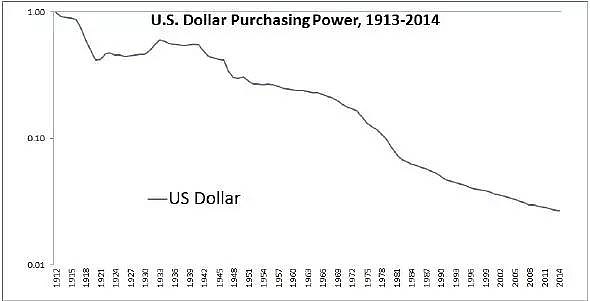

Investing in the US stock market comes with its own set of risks. It's crucial to understand the potential risks and how they may affect your investments. These risks include market volatility, currency exchange rates, and political and economic instability in the US. Educate yourself on these risks and develop a sound investment strategy to mitigate them.

Researching and Selecting Stocks

To make informed investment decisions, conduct thorough research on the companies you are interested in. Analyze their financial statements, market trends, and competitive position. Consider the following factors when selecting stocks:

- Industry: Invest in industries with strong growth potential and stable demand.

- Company Financials: Look for companies with strong revenue growth, low debt levels, and positive cash flow.

- Management: Assess the experience and track record of the company's management team.

Understanding Tax Implications

Foreign investors must be aware of the tax implications of investing in US stocks. The US government imposes a 30% withholding tax on dividends paid to foreign investors. However, certain tax treaties may reduce this rate. It's essential to consult with a tax professional to understand your tax obligations and ensure compliance.

Diversifying Your Portfolio

Diversification is key to managing risk and maximizing returns. Consider investing in a mix of stocks across various industries and geographical regions. This strategy helps to minimize the impact of market downturns and increases your chances of achieving long-term growth.

Case Study: XYZ Corporation

Let's consider a hypothetical example of a foreign investor, John, who decides to invest in XYZ Corporation, a US-based technology company. After conducting thorough research, John determines that XYZ Corporation has a strong market position and solid financials. He decides to invest $10,000 in the company's stock.

Over the next five years, XYZ Corporation experiences significant growth, and John's investment appreciates to $20,000. By diversifying his portfolio and understanding the risks involved, John successfully navigates the US stock market and achieves a substantial return on his investment.

Conclusion

Investing in US stocks can be a rewarding opportunity for foreign investors. By following the steps outlined in this article, you can make informed investment decisions and potentially achieve long-term growth. Remember to do thorough research, understand the risks, and diversify your portfolio to maximize your chances of success.

new york stock exchange