As the global financial landscape continues to evolve, investors are constantly seeking opportunities to maximize their returns. One of the most popular markets for investment is the United States stock market. But should you invest in US stocks now? Let's delve into the factors that can help you make an informed decision.

Economic Stability and Growth

The United States has long been considered a stable and robust economy. Over the past few years, the US has witnessed steady economic growth, low unemployment rates, and strong consumer confidence. These factors contribute to a favorable environment for the stock market.

Historical Performance

Historically, the US stock market has offered impressive returns. The S&P 500, a widely followed benchmark index, has returned an average of 10% annually over the past 100 years. This performance has made it a compelling investment option for many investors.

Diversification

Investing in US stocks can provide diversification benefits. By investing in a variety of companies across different sectors, you can reduce your exposure to the risks associated with a single stock or industry.

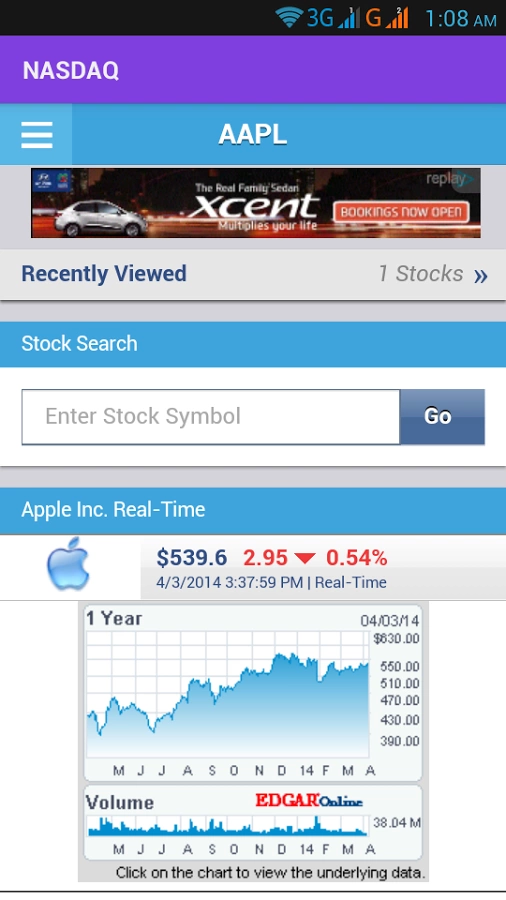

Technology and Innovation

The US is home to some of the world's leading technology companies, such as Apple, Microsoft, and Google. These companies have driven significant growth in the stock market and continue to innovate, creating opportunities for investors.

Low Interest Rates

Historically low interest rates have made investing in stocks more attractive than holding cash or fixed-income investments. This is because stocks offer the potential for higher returns, especially when compared to low-yielding bonds.

Market Valuations

While the US stock market has been on a bull run for several years, some investors are concerned about its current valuations. The S&P 500 is currently trading at around 23 times its trailing 12-month earnings, which is above its historical average of 16 times. This suggests that the market may be overvalued.

Geopolitical Risks

Geopolitical tensions, such as trade wars and political instability, can impact the stock market. It's essential to stay informed about these risks and consider their potential impact on your investments.

Case Study: Amazon

Consider Amazon, a company that has revolutionized the retail industry. When Amazon went public in 1997, its stock was priced at

In conclusion, investing in US stocks can offer several benefits, including diversification, potential for high returns, and exposure to leading companies. However, it's essential to consider market valuations, geopolitical risks, and other factors before making an investment decision. As always, consult with a financial advisor to ensure that your investment strategy aligns with your goals and risk tolerance.

new york stock exchange