The stock market is a dynamic and ever-evolving landscape, where investors seek to capitalize on the latest trends and opportunities. The recent momentum in the US stock market has been a topic of intense interest for both retail and institutional investors alike. This article delves into the key factors driving this momentum and provides insights into the potential future trends.

Understanding the Current Stock Market Trend

The recent momentum in the US stock market can be attributed to several key factors. One of the primary drivers has been the strong economic data, particularly in the areas of employment and consumer spending. The U.S. unemployment rate has reached historic lows, indicating a robust labor market. This, coupled with rising consumer confidence, has fueled the demand for stocks, leading to higher prices.

Impact of Technology Stocks

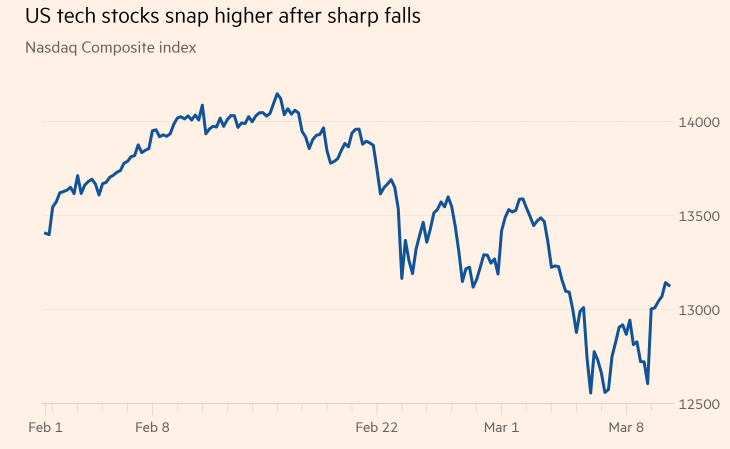

Technology stocks have played a significant role in the recent momentum. Companies like Apple, Microsoft, and Amazon have continued to deliver strong earnings reports, driving their share prices higher. The FAANG stocks, which include Facebook, Apple, Amazon, Netflix, and Google's parent company Alphabet, have been a major force behind the market's upward trend.

The Role of the Federal Reserve

The Federal Reserve's monetary policy has also played a crucial role in the stock market's momentum. The central bank has maintained a low-interest rate environment, making borrowing cheaper and encouraging investors to seek higher returns in the stock market. This policy has been particularly beneficial for growth stocks and high-yield bonds.

Sector Performance

Different sectors have shown varying levels of momentum. The technology, healthcare, and financial services sectors have been the standout performers, while sectors like energy and real estate have lagged behind. This diversification in sector performance has provided investors with a wide range of opportunities to capitalize on the momentum.

Case Studies:

- Apple Inc.: The tech giant has seen a significant increase in its share price, driven by its strong performance in the smartphone and services segments. The company's revenue and earnings have continued to grow, making it a favorite among investors.

- Amazon.com Inc.: The e-commerce giant has seen its stock price soar due to its robust growth in the cloud computing segment, particularly through its Amazon Web Services (AWS) division.

Future Trends

While the current momentum in the US stock market is encouraging, it is important to remain cautious. The market is unpredictable, and there are several potential risks that could impact the momentum. These include geopolitical tensions, trade disputes, and changes in monetary policy.

Conclusion

The recent momentum in the US stock market has been driven by a combination of strong economic data, favorable monetary policy, and robust performance in key sectors. However, investors should remain vigilant and be prepared for potential market volatility. By understanding the key factors driving the momentum and staying informed, investors can make informed decisions and capitalize on the opportunities presented by the current market environment.

new york stock exchange