Embarking on the Journey to U.S. Stock Market

Investing in the U.S. stock market from India can be an exciting and lucrative opportunity. However, it's crucial to understand the process and the potential risks involved. This guide will help you navigate through the steps required to invest in U.S. stocks from India.

Understanding the Basics

First, it's important to understand that the U.S. stock market operates differently from the Indian stock market. The trading hours, market regulations, and the types of stocks available may differ. Therefore, doing thorough research is essential before making any investments.

Open a Brokerage Account

To start investing in U.S. stocks, you need to open a brokerage account with a U.S.-based brokerage firm. This account will act as your gateway to the U.S. stock market. Many reputable brokerage firms, such as TD Ameritrade, E*TRADE, and Fidelity, offer services to international investors.

When choosing a brokerage firm, consider factors such as fees, customer service, and the types of investment options they offer. It's also important to ensure that the brokerage firm is regulated by a recognized financial authority in the U.S.

Understand U.S. Stock Market Regulations

The U.S. stock market operates under strict regulations set by the Securities and Exchange Commission (SEC). It's crucial to understand these regulations to avoid any legal issues. For instance, you need to be aware of the rules regarding insider trading, short selling, and margin requirements.

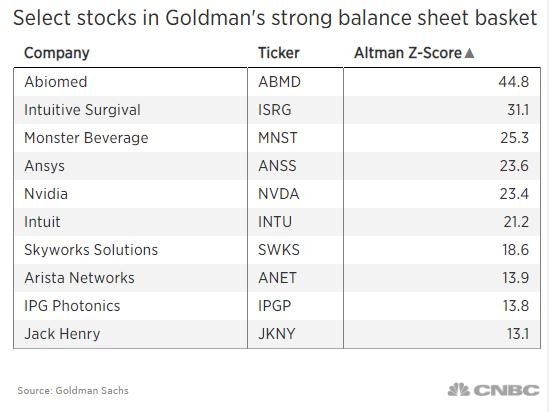

Research U.S. Stocks

Once you have your brokerage account set up, the next step is to research potential stocks to invest in. This involves analyzing the financial statements, earnings reports, and market trends of the companies you're interested in.

Use financial websites, investment forums, and stock market analysis tools to gather information. Some popular tools include Google Finance, Yahoo Finance, and Motley Fool.

Consider Your Investment Strategy

Before making any investments, decide on your investment strategy. Are you looking for long-term growth, or do you prefer short-term trading? Do you want to invest in a specific sector, or are you looking for a diversified portfolio?

Your investment strategy will determine the types of stocks you should consider. For instance, if you're looking for long-term growth, you might consider investing in tech stocks or blue-chip companies.

Understand Currency Conversion

When investing in U.S. stocks from India, you'll need to convert your Indian rupees to U.S. dollars. Keep in mind that currency exchange rates can fluctuate, which may impact your investment returns.

Monitor Your Investments

Once you've made your investments, it's important to monitor them regularly. This will help you stay informed about the performance of your investments and make informed decisions when necessary.

Case Study: Investing in Tesla from India

Consider the case of an Indian investor who invested in Tesla (TSLA) shares through a U.S. brokerage account. After doing thorough research, the investor decided to buy 100 shares of Tesla at

This case highlights the potential of investing in U.S. stocks from India. However, it's important to note that stock market investments are subject to risks, and it's crucial to do thorough research before making any decisions.

Conclusion

Investing in the U.S. stock market from India can be a rewarding experience if done correctly. By following these steps and understanding the potential risks, you can navigate the U.S. stock market and make informed investment decisions.

new york stock exchange