As we approach the end of 2025, the US stock market is a topic of significant interest for investors and financial analysts alike. This article delves into the current outlook for the US stock market in August 2025, examining key trends, market indicators, and potential risks and opportunities.

Market Performance

In recent years, the US stock market has experienced a rollercoaster of highs and lows. However, as we enter August 2025, the market appears to be on an upward trajectory. The S&P 500, a widely followed benchmark index, has seen significant gains, driven by strong corporate earnings and a recovering economy.

Trends to Watch

Tech Stocks: Technology stocks have been a major driver of the market's growth. Companies like Apple, Microsoft, and Amazon have seen substantial increases in their share prices, contributing to the overall market performance.

Energy Sector: The energy sector has also experienced a resurgence, with oil and gas prices reaching record highs. This has been a boon for companies in the industry, leading to increased revenue and profits.

Economic Recovery: The US economy has shown signs of recovery, with unemployment rates falling and consumer spending increasing. This has bolstered investor confidence and contributed to the market's growth.

Market Indicators

Several key indicators suggest that the US stock market is poised for continued growth in August 2025:

Earnings Reports: Corporate earnings reports have been strong, with many companies exceeding expectations. This has led to increased optimism among investors.

Interest Rates: The Federal Reserve has maintained a cautious approach to interest rates, keeping them at historically low levels. This has made borrowing cheaper and encouraged investors to take on more risk.

Consumer Sentiment: Consumer sentiment has improved, with consumers feeling more confident about the economy and their personal financial situations.

Risks and Opportunities

While the outlook for the US stock market in August 2025 appears promising, there are still potential risks and opportunities to consider:

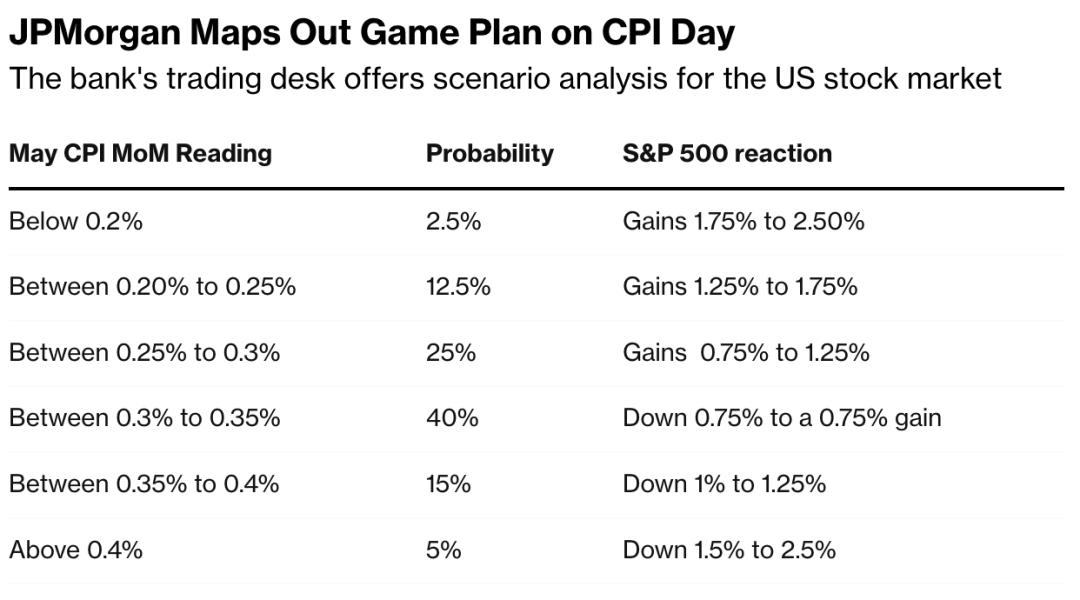

Inflation: Inflation remains a concern, with the Consumer Price Index (CPI) reaching record highs. This could lead to higher interest rates and potentially slow down economic growth.

Geopolitical Tensions: Tensions between the US and other countries, such as China, could impact global markets and the US stock market.

Sector Rotation: Investors may start to rotate out of high-growth sectors like technology and into more value-oriented sectors, such as financials and healthcare.

Case Studies

To illustrate the potential of the US stock market in August 2025, let's consider a few case studies:

Apple Inc.: Apple has seen significant growth in its share price, driven by strong demand for its products and services. The company's strong financial performance and innovative products have made it a favorite among investors.

ExxonMobil Corporation: ExxonMobil has seen a resurgence in its share price, driven by higher oil and gas prices. The company's strong financial performance and commitment to innovation have made it a leader in the energy sector.

Tesla, Inc.: Tesla has been a major driver of growth in the technology sector. The company's electric vehicles and renewable energy solutions have captured the attention of investors and consumers alike.

In conclusion, the US stock market in August 2025 appears to be on a positive trajectory, driven by strong corporate earnings, economic recovery, and technological advancements. However, investors should remain vigilant about potential risks and opportunities. By staying informed and making informed decisions, investors can navigate the market's ups and downs and achieve their financial goals.

new york stock exchange